Capital Gains Tax Deferral With 1031 Exchange DST Properties

Get Your 1031 Property List Now!

- 75+ DST OFFERINGS

- 60+ DST SPONSORS

- 50+ YEARS EXPERIENCE

- $1B TRANSACTION VOLUME

- DIVERSIFIED INVESTMENT STRATEGY

- 1031 EXCHANGE APPROVED

- LOW MINIMUM INVESTMENTS

- 2-3 DAY FAST CLOSE

What Is A Delaware Statutory Trust (DST)?

- A Delaware Statutory Trust (DST) is a legal entity created under Delaware law that permits fractional ownership of real estate assets

- DSTs are classified as “direct interests” and possess the unique ability to qualify for 1031 exchange

- Tax benefits include capital gains and depreciation recapture deferral, mortgage interest deductions, and more

- An Exchanger can choose to defer taxes by reinvesting in a DST, rather than a traditional fee-simple property

DST Potential Advantages

- Institutional-quality real estate

-

Professional asset & property

management

- Turnkey/Passive ownership

- Ability to close quickly

- Non-recourse debt

- 1031 identification & boot backup

- Diversification (Geographic, asset type, allocation, debt structure, tenants)

- Simple tax reporting

- Estate planning flexibility

- Lower minimum investments

GET FREE ACCESS

Download 1031 Exchange DST Replacement Property List

- Your Information is Secure. Opt Out at Anytime.

Register Now and Receive

- DST Property Listings

- Free eBook

- Insights, News & More

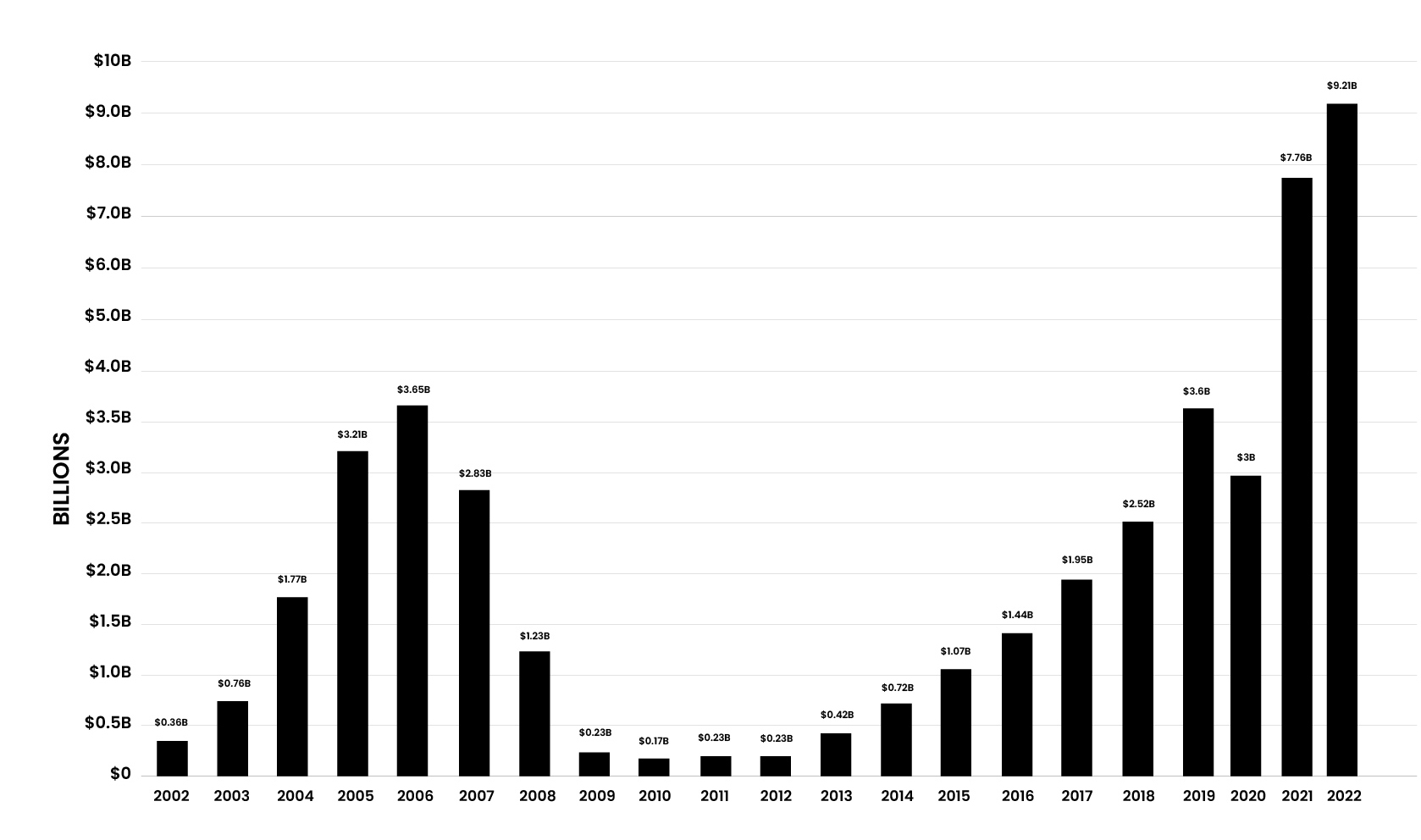

The DST Industry

DST's Have Grown in Popularity

Securitized Fundraising (TIC And DST)

*There is no guarantee of success. Investors could incur a loss of all or a portion of their investment

*Source: Mountain Dell Consulting, LLC 2022 Research Report

Featured Offerings

CPA Arbour Commons DST

- Westminster, CO

Arbour Commons is a Class A multifamily complex located in the affluent market of Westminster located just 25 minutes away from downtown…

Asset Class

Multifamily

Syndicated Purchase Price

$170,739,000

Year Built

2014

LTV

43.70%

Targeted Investment Period

7-10 Years

Minimum Investment

$100,000

Las Vegas Training Facility DST

- Henderson, NV

LV Training Facility is a newly constructed build-to-suit complex for the Las Vegas Raiders NFL footbal team. The property consists of…

Asset Class

Mixed Use

Syndicated Purchase Price

$270,381,983

Year Built

2019

LTV

78.70%

Targeted Investment Period

7-10 Years

Minimum Investment

$25,000

Moody Village Towers DST

- Houston, TX

Village Towers is an class A office building with retail space located at 9651 in Houston, Texas on Katy Freeway situated on approximately 5.178 acres…

Asset Class

Office

Syndicated Purchase Price

$210,750,000

Year Built

2020

LTV

37.27%

Targeted Investment Period

7-10 Years

Minimum Investment

$50,000

PROPERTY TYPES

- Multifamily

- Net Lease

- Retail

- Office

- Self Storage

- Industrial

- Medical Office

- Assisted Living Facility

- Manufactured Housing

HOW DOES A 1031 EXCHANGE WORK?

Process Of A Typical 1031 Exchange

EXCHANGER SELLS PROPERTY

and proceeds are escrowed with a Ql

QUALIFIED INTERMEDIARY TRANSFERS FUNDS

for purchase of replacement property

INTERMEDIARY COMPLETES EXCHANGE

by acquiring replacement property or properties

Benefits Of Deferred Taxation

EXCHANGE VS. NON-EXCHANGE

SCENARIO

*Each investor should consider his or her current and anticipated investment horizon and income tax bracket when making an investment decision, as the illustration may not reflect these factors.

**This assumes straight-line depreciation

***This assumes the taxpayer is in the highest applicable federal and state tax brackets. If your tax rate is lower, you could have a reduced benefit.

WHY EXCHANGE-X?

Largest 1031 Replacement Property Inventory

50+ Sponsors

State-of-the-Art Investment Platform

50+ years combined experience

$1B+ in Transactions

20+ year track record

WHY EXCHANGE-X?

Largest 1031 Replacement Property Inventory

50+ Sponsors

State-of-the-Art Investment Platform

50+ years combined experience

$1B+ in Transactions

20+ year track record

How It Works

Getting started with Exchange-X couldn’t be easier. Follow our 3-step process and reach out with any questions you may have. We’re here for you.

Sign up for a free account to gain instant access to our platform where you can easily confirm your accreditation, review inventory, download offering memos, and more.

Timeline

1031 Exchange Identification Rules

Replacement Rules

To successfully complete an Exchange and defer capital gains taxes, investors need to satisfy the following requirements:

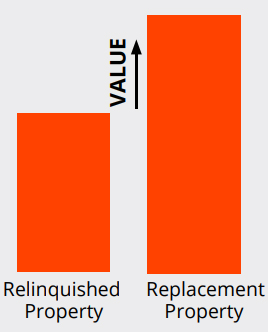

VALUE

Purchase a property of equal or greater value.

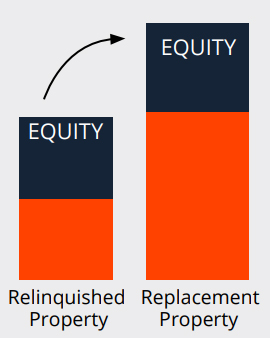

EQUITY

Reinvest all of the equity in a replacement property. Note: Any equity not reinvested will be subject to tax.

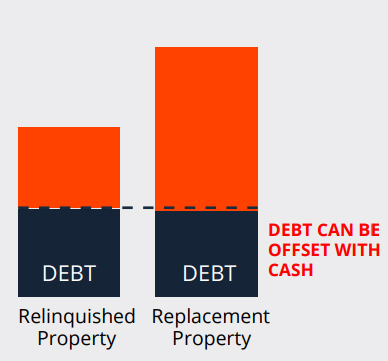

DEBT

Obtain equal or greater debt on the replacement property. Exception: Reduction in debt can be offset with additional cash from the exchanger.

Here Are Some Of Our Great Reviews...

WE CAN'T WAIT TO ADD YOURS

Past Testimonials do not guarantee future performance or success.

Testimonials may not be representative of the experience of other customers.

Full Disclaimer Copyright 2023 Exchange-X, LLC. All rights reserved. The contents of this communication: (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, (ii) offers can be made only by the confidential Private Placement Memorandum (the “PPM”) which is available upon request, (iii) do not and cannot replace the PPM and is qualified in its entirety by the PPM, and (iv) may not be relied upon in making an investment decision related to any investment offering by the respective issuer, or any affiliate, or partner thereof (“Issuer”). All potential investors must read the PPM and no person may invest without acknowledging receipt and complete review of the PPM. With respect to the “targeted” goals and performance levels outlined herein, these do not constitute a promise of performance, nor is there any assurance that the investment objectives of any program will be attained. These “targeted” factors are based upon reasonable assumptions more fully outlined in the Offering Documents/ PPM. Consult the PPM for investment conditions, risk factors, minimum requirements, fees and expenses and other pertinent information with respect to any investment. These investment opportunities have not been registered under the Securities Act of 1933 and are being offered pursuant to an exemption therefrom and from applicable state securities laws. Past performance are no guarantee of future results. All information is subject to change. You should always consult a tax professional prior to investing. Investment offerings and investment decisions may only be made on the basis of a confidential private placement memorandum issued by Issuer, or one of its partner/issuers. Issuer does not warrant the accuracy or completeness of the information contained herein. Thank you for your cooperation. Securities offered through Metric Financial Member: FINRA, SIPC. Only available in states where Metric Financial is registered. Metric Financial is not affiliated with any other entities identified in this communication. For more information, read our Disclosures & Disclaimers and Terms of Service.

1031 Risk Disclosure:

- There is no guarantee that any strategy will be successful or achieve investment objectives;

- Potential for property value loss – All real estate investments have the potential to lose value during the life of the investments;

- Change of tax status – The income stream and depreciation schedule for any investment property may affect the property owner’s income bracket and/or tax status. An unfavorable tax ruling may cancel deferral of capital gains and result in immediate tax liabilities;

- Potential for foreclosure – All financed real estate investments have potential for foreclosure;

- Illiquidity – Because 1031 exchanges are commonly offered through private placement offerings and are illiquid securities. There is no secondary market for these investments;

- Reduction or Elimination of Monthly Cash Flow Distributions – Like any investment in real estate, if a property unexpectedly loses tenants or sustains substantial damage, there is potential for suspension of cash flow distributions;

- Impact of fees/expenses – Costs associated with the transaction may impact investors’ returns and may outweigh the tax benefits.

Copyright © 2023 Exchange-X All Rights Reserved.