What is a Delaware Statutory Trust (DST)?

A Delaware Statutory Trust (DST) is a legal entity (similar to an LLC) created under Delaware law that permits fractional ownership of real estate assets. DSTs are classified as “direct interests” and possess the unique ability to qualify for 1031 exchange. Tax benefits include depreciation, mortgage interest deductions, and many more.

To learn more about Delaware Statutory Trusts, download our free eBook titled “The Power of 1031 Exchanges and Delaware Statutory Trusts (DSTs)” and visit our Resource Center.

Recensione del casinò Wazamba

Wazamba Casino offre un’esperienza di gioco eccellente. La grafica è accattivante e la varietà di giochi è casinò Wazamba impressionante. Il servizio clienti è sempre disponibile e molto professionale. Il bonus di benvenuto è generoso e i tempi di prelievo sono rapidi. Consiglio vivamente Wazamba per un divertimento sicuro e coinvolgente.

Simplicity & Flexibility

DST properties offer 1031 exchange investors the simplicity and flexibility to close quickly when faced with strict 1031 timelines.

Institutional Quality Real Estate

Access institutional grade real estate in high barrier-to-entry markets allowing partial ownership in properties that would otherwise be out-of-reach.

Best-in-Class Property Management

Experienced asset and property managers handle day-to-day operations eliminating management responsibilities.

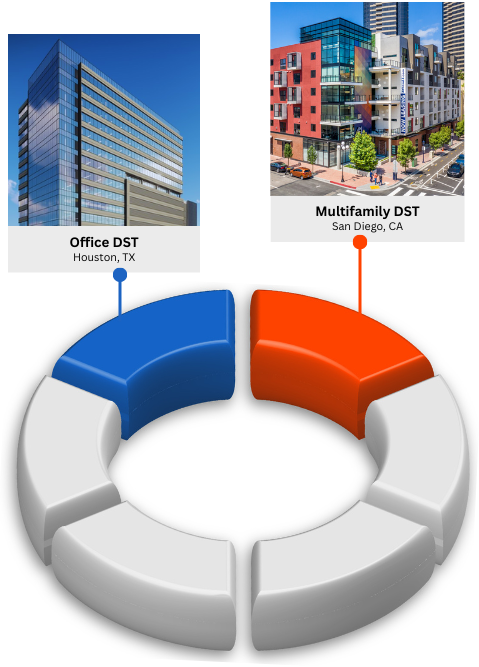

Diversification

Investors can divide their investments among multiple DSTs, which may provide for a more diversified real estate portfolio across various geographical locations and property types.

Tax Optimization

DST properties offer similar tax advantages to owning traditional real estate in addition to simplified year-end tax reporting.

Lower Minimum Investments

DST properties accommodate lower minimum investments versus traditional real estate. Lower minimums can also benefit 1031 exchange investors through added diversification, timeline crunches, leftover exchange boot and ID backup insurance.

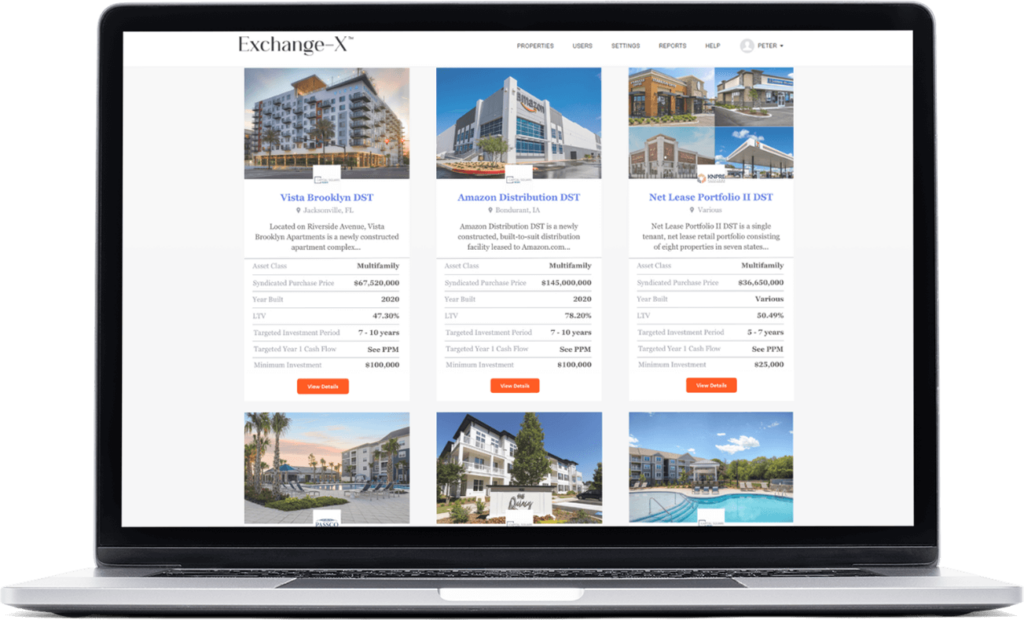

The Exchange-X

Experience

Exchange-X is a premier real estate investment firm for 1031 exchange DST properties.

Simply create an account and access 1031 replacement properties today.

Closed Investments

Take a look at some of our closed investments and you’ll see the diverse portfolio available to you.

Join Exchange-X today to view our open investments!

Apex South Creek DST

- Orlando, FL

The Property is a Class A, garden-style multi-family residential community located in Orlando, Florida known as “Apex South Creek.

Asset Class

Offering Price

Year Built

LTV

Estimated Hold Period

Projected Year 1 Cash Flow

Storage IV DST

- Arizona & Florida

Storage IV DST is a three property portfolio consisting of (3) self-storage properties located in Phoenix, Arizona and Saint Petersburg Florida (7th Street).

Asset Class

Offering Price

Year Built

LTV

Estimated Hold Period

Projected Year 1 Cash Flow

Amazon Industrial Portfolio DST

- Florida & Kansas

Amazon Industrial Portfolio DST is comprised of two, newly constructed Amazon industrial distribution centers located in the Fort Meyers Florida…

Asset Class

Offering Price

Year Built

LTV

Estimated Hold Period

Projected Year 1 Cash Flow

LV Training Facility DST

- Las Vegas, NV

LV Training Facility DST is a newly constructed, build-to-suit mixed use complex built for the Las Vegas Raiders to use as their training facility…

Asset Class

Offering Price

Year Built

LTV

Estimated Hold Period

Projected Year 1 Cash Flow

Madison Farms DST

- Charlotte, NC

Madison Farms is a 248-unit, new construction garden-style apartment investment opportunity just northeast of the intersection of…

Asset Class

Offering Price

Year Built

LTV

Estimated Hold Period

Projected Year 1 Cash Flow

Net Lease All Cash 4 DST

- FL & NC

Net Leased All Cash 4 DST is a diversified retail portfolio consisting of 3 net-lease properties in 2 states with national corporate leases backed…

Asset Class

Offering Price

Year Built

LTV

Estimated Hold Period

Projected Year 1 Cash Flow

200 Park Place DST

- Houston, TX

200 Park Place DST is a newly built, Class-AA boutique office building located in the River Oaks District micro-market of Houston, Texas.

Asset Class

Offering Price

Year Built

LTV

Estimated Hold Period

Projected Year 1 Cash Flow

Carriage Homes on the Lake DST

- Garland, TX

BV Carriage Homes on the Lake DST, commonly known as “Carriage Homes on the Lake” is a multifamily residential community which consists …

Asset Class

Offering Price

Year Built

LTV

Estimated Hold Period

Projected Year 1 Cash Flow

Jefferson NC Portfolio DST

- West Jefferson, NC

West Jefferson NC Portfolio DST is a four (4) property self storage portfolio located in West Jefferson North Carolina which contains 219 storage units…

Asset Class

Offering Price

Year Built

LTV

Estimated Hold Period

Projected Year 1 Cash Flow