Exchange-X is a leading 1031 Exchange real estate investment firm for Delaware Statutory Trust (DST) properties. Exchange-X offers access to leading DST sponsors and dozens of active offerings.

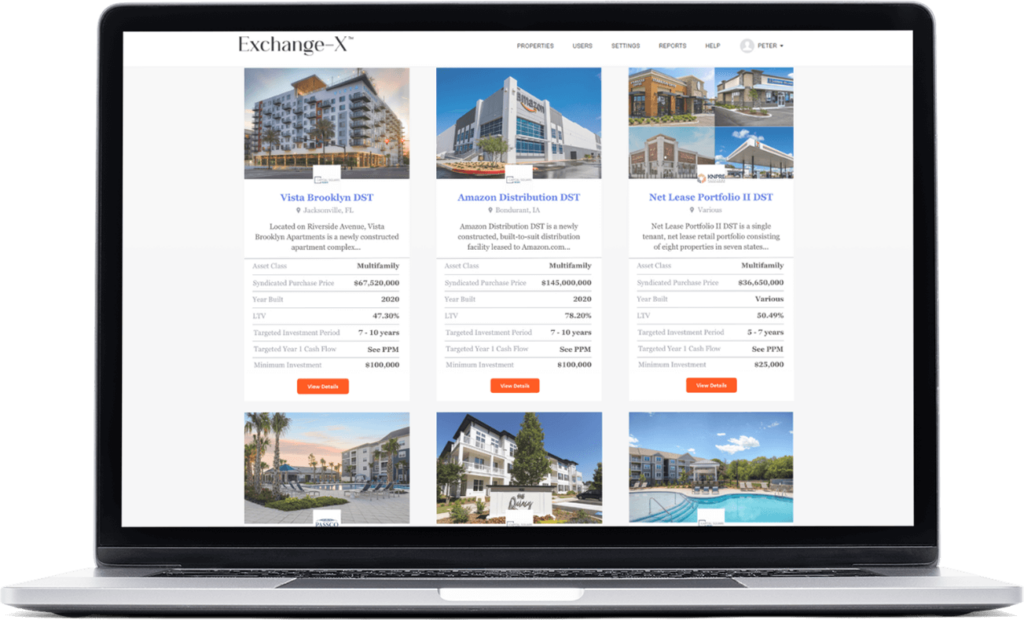

Featured Offerings

- Deerfield, FL & Richardson, TX

Asset Class

Offering Price

Year Built

LTV

Estimated Hold Period

Projected Year 1 Cash Flow

Join to View

- Ponder, TX

Asset Class

Offering Price

Year Built

LTV

Estimated Hold Period

Projected Year 1 Cash Flow

Join to View

- Aberdeen, NC

Asset Class

Offering Price

Year Built

LTV

Estimated Hold Period

Projected Year 1 Cash Flow

Join to View

- Kissimmee, FL

Asset Class

Offering Price

Year Built

LTV

Estimated Hold Period

Projected Year 1 Cash Flow

Join to View

- Sacramento, CA

Asset Class

Offering Price

Year Built

LTV

Estimated Hold Period

Projected Year 1 Cash Flow

Join to View

- Houston, TX

Asset Class

Offering Price

Year Built

LTV

Estimated Hold Period

Projected Year 1 Cash Flow

Join to View

The Exchange-X

Experience

Exchange-X is a premier real estate investment firm for 1031 exchange DST properties.

Simply create an account and access 1031 replacement properties today.

What Makes Us The Best

Largest 1031 Replacement Property Inventory

State-of-the-Art Investment Website

$1B+ in

Transactions

70+ Sponsors

20+ year track record

5-Star Google Rated

How It Works

1.Create an Account

Create an Account

2.Browse 1031 Properties

Browse the Platform

3.Invest

& Close

Invest & Close

Frequently Asked Questions

A Delaware Statutory Trust (DST) is a legal entity (similar to an LLC) created under Delaware law that permits fractional ownership of real estate assets. DSTs are classified as “direct interests” and possess the unique ability to qualify for 1031 exchange. Tax benefits include depreciation, mortgage interest deductions, and many more.

To learn more about Delaware Statutory Trusts (DSTs), we encourage investors to read our free eBook titled “The Power of 1031 Exchanges and Delaware Statutory Trusts (DSTs)” or visit our Education Center.

Our DST properties are set up as SEC Regulation D 506(b) and 506(c) private placement offerings. Per SEC rules, investors must be deemed an “Accredited Investor” to invest.

Please refer here for the latest definition.

- Individual

- Joint WROS

- Joint TIC

- Trust (Revocable or Irrevocable)

- Sole Proprietorship

- Limited Liability Corporation (LLC)

- Corporate (S or C)

- General Partnership

- Limited Partnership

- DVP/RVP

- And many more.

Simply create an account and browse.

Once completed, a licensed advisor will reach out to assist with any further questions.

Featured Posts

5 Steps to Take Before Your 1031 Exchange

What is a 1031 Exchange?

What is a Delaware Statutory Trust (DST)?

5-Star Google Rated

WE CAN'T WAIT TO ADD YOURS

His market knowledge, insight and vision have illuminated areas of investing and CRE that I had not explored. I thank him for that. I highly recommend and trust Peter. Don't miss an opportunity to connect with and work together with Peter. You will be happy you did.

Past Testimonials do not guarantee future performance or success.

Testimonials may not be representative of the experience of other customers.