So, you have decided to go through with a 1031 exchange to defer costly capital gain and depreciation recapture taxes. Smart move!! With that in mind, a 1031 Exchange can be a daunting process which may leave most property owners in confusion. There are many steps to consider upon selling your property which only seasoned investors or Qualified Intermediaries (QI) may be familiar with. In this article we will discuss several steps to take before entering a 1031 exchange and more importantly, how to successfully complete one.

The 5 steps to consider before entering a 1031 exchange are:

- Include QI Before the Close

- Include Exchange Language in Sales Contract

- Know the Rules of an Exchange

- Identify Replacement Properties Early

- Use a Delaware Statutory Trust (DST) as a Backup

Include QI Before the Close

If you feel a 1031 is right for you, it’s essential that you familiarize yourself with the general mechanics. To facilitate a 1031 exchange, the Qualified Intermediary (QI) aka the 1031 Accommodator must be included in the sales process on the front end before the relinquished property is closed. The Qualified Intermediary (QI) is an independent entity that acks as the liaison on behalf of the seller and ensures the exchange remains compliant with the rules and regulations of IRC section 1031.

Think of the Qualified Intermediary (QI) as the glue that holds the buyer and seller together in a 1031 exchange. Aside from being the heart of the exchange itself, the main function of the QI is to restrict the investor’s access to the sale proceeds upon the sale of the relinquished property and comply with the “safe harbor” rules set out in reg. 1.1031(k)-1(g)(4). This is done by holding the final sales proceeds of the relinquished property in a qualified escrow account specifically dedicated to holding exchange funds.

Cytotec Venezuela – Misoprostol Cytolog Price – TB Fitness anavar per ottenere fantastici risultati attrezzature allenamento | gym’s garage | attrezzature fitness e pavimentazione palestre

At Exchange-X, we work with leading QIs around the country and can refer several reputable accommodators in your local area. Please contact us for a current list of QIs.

Include Exchange Language in the Sales Contract

1031 Tax-Deferred Exchange Contract Language refers to the contractual language used in real estate when a taxpayer wishes to sell one property and buy another for investment purposes. Most newbie exchangers overlook this very important step.

When it comes to real estate investments, the Internal Revenue Code requires specific language in both purchase and sale agreements establishing an investor’s intent to perform an exchange. This language specifies that an investor intends to sell their investment property and purchase a new one for investment purposes. For such an exchange to occur, the contract must express this intention. This is necessary in order for the exchange to qualify for the IRS.

Also, the language provides advance notification to the other party stating the contract will need to be assigned to an intermediary. This can typically be done before the contract is drafted or be added to an existing contract through an addendum. It’s important to note, if exchange language is excluded from the contract or funds are taken into possession upon the close, the exchange will be terminated.

Know the Rules of an Exchange

There are very specific identification period requirements for a 1031 exchange. If you’ve read our article on how a 1031 exchange works, you are familiar with the strict IRS deadlines that must be followed. To meet those deadlines, it’s important to understand the rules surrounding identifying replacement properties.

45-Day Identification & 180-Day Closing Timelines

Replacement properties under consideration for acquisition in a 1031 exchange should be identified to the QI and must be identified no later than midnight of the 45th calendar day following the close of the relinquished property sale transaction.

Once identified, the exchanger has an additional 135 calendar days (180 days from sale of relinquished property date) to officially close on the identified replacement property(s) in order to successfully satisfy the exchange. Weekends and holidays are not excluded from 1031 exchange timeline rules. Be sure to work closely with your chosen QI in order to stay on top of important deadlines.

Like Kind

Another important factor to consider before conducting a 1031 exchange is the type of real estate interests that qualify for an exchange, commonly referred to as “like-kind” properties. This simply means that the investor must exchange one form of real property for another.

A lot of people assume that like-kind property means if you sell an office building you can only buy another office building, or that an apartment complex can only get you another apartment complex. However, this is not the case. The like-kind requirement simply means that you must exchange one form of real property for another.

In general, office buildings, warehouses, retail centers, land, multifamily and single-family rentals will all qualify for a 1031 exchange. Even more obscure assets like mineral, water or air rights can qualify, as well as easements and development rights.

Identification Rules

When identifying potential replacement properties, 1031 exchange investors must comply with one of the three property identification rules. These rules include the Three Property Identification Rule, the 200% of Fair Market Value Identification Rule, and the 95% Identification Exception.

- Three-Property Rule: Identification of up to three properties regardless of the total value of property identified.

- 200% Rule: Identification of any number of properties wherein the combined FMV (fair market value) does not exceed 200 percent of the relinquished properties’ FMV.

- 95% Rule: Identification of any number of properties regardless of the aggregate FMV, as long as at least 95 percent of the property is ultimately acquired. This rule is only used when more than three properties are identified with a total aggregate FMV exceeding 200%.

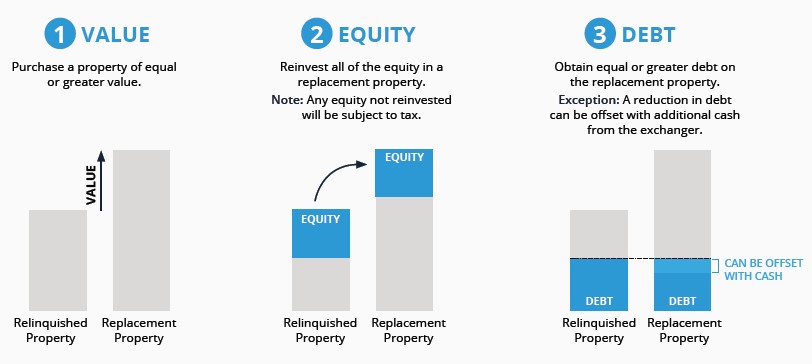

Replacing Equal or Greater Value, Equity and Debt

For the 1031 exchange to work as it is designed, in most cases you’ll want to purchase a property of equal or greater value than the one you are selling. This difference in value is what will allow you to grow your portfolio and “trade up,” which is typically what you are trying to accomplish when utilizing a 1031 exchange.

Trading into a property with a equal or greater value is also what allows the rules surrounding your equity to work correctly. To avoid paying any capital gains tax on the transaction, you must reinvest all the equity from the relinquished property into the new property. If there is equity left over that is not reinvested, aka boot, that amount will be taxed.

For further detail regarding these topics, we encourage your to read our blogs titled How does a 1031 Exchange Work?, What Qualifies as a “Like-Kind” Property in a 1031 Exchange and What are the Rules of a 1031 Exchange?

Identify Replacement Properties Early

There is nothing more underestimated in a 1031 exchange then the amount of time you are allotted to identify a replacement property. The IRS allows an exchanger only 45-days to properly identify a list of replacement property(s). This may seem sufficient, but when attempting to identify, submit LOIs, negotiate, inspect and coordinate all interested parties, this time passes quickly.

We recommend looking for replacement properties early, even before you close. This will allow you to optimize the entire 45-day ID period to perform proper due diligence and leave time in the event a property falls through.

Use a Delaware Statutory Trust (DST) as a Backup

When faced with strict timelines to identify suitable replacement properties for an exchange, you owe it to yourself to evaluate a Delaware Statutory Trust (DST) and the many benefits one can offer. Consider using a Delaware Statutory Trust (DST) as 1031 exchange backup. This is an excellent strategy to ensure (not guarantee) an investor can successfully close on the properties identified. Due to the nature of DSTs being pre-vetted, pre-financed, and pre-closed, this alleviates the many possibilities of a failed exchange due to complications surrounding sellers, lenders, etc.

The Delaware Statutory Trust can also be a great alternative for landlords looking to delegate property management responsibilities to a third-party management company. DST properties are managed by best-in-class property management firms making the DST a preferred alternative solution for passive, turnkey investing.

DSTs may be suitable if you are a property owner who:

- No longer wants to actively manage real estate

- Wants to diversify their investment portfolio

- Wants to limit personal liability

- Wants to commit a smaller investment amount

- Needs to ID & close quickly

Read Using a Delaware Statutory Trust (DST) as 1031 Exchange Backup to learn more.

Conclusion

When performing a 1031 exchange, the IRS has many stringent rules and regulations regarding the 1031 exchange code. Meeting deadlines can be difficult and can sometimes lead to a failed exchange. Luckily, investors today have many resources to protect their investments. Even when faced with a potential failed exchange, there are many ways to preserve your 1031.

It is strongly recommended to identify more than one replacement property as backup in the event problems arise with the first target acquisition property. By identifying a second or third replacement property, you significantly increase your ability to successfully 1031 exchange.

A Delaware Statutory Trust (DST) may be a powerful alternative. Since DST properties are pre-vetted, pre-financed and pre-closed, a DST can offer exchangers the ability to close quickly and alleviate securing additional financing from lenders.

In addition, DST properties come with professional property managers to handle all aspects of leasing, maintenance, and management efforts for simple, turnkey ownership. By identifying a DST property as 1031 backup, an investor can gain the confidence to successfully close their exchange by eliminating most issues associated with a traditional exchange.

Get the backup you need with Exchange-X, the leading DST investment platform. Gain instant access to dozens of 1031 eligible commercial properties to choose from.

For more information, schedule a consultation with one of our experts or call (888) 775-1031 today.

Join Exchange-X! Click the link above to create an account now and be the first to know about upcoming opportunities.

Download your free copy of “The Power of 1031 Exchanges and Delaware Statutory Trusts (DSTs)” to learn more about how Delaware Statutory Trusts (DST) can complement your portfolio.

Full Disclaimer Copyright 2023 Exchange-X, LLC. All rights reserved.

The contents of this communication: (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, (ii) offers can be made only by the confidential Private Placement Memorandum (the “PPM”) which is available upon request, (iii) do not and cannot replace the PPM and is qualified in its entirety by the PPM, and (iv) may not be relied upon in making an investment decision related to any investment offering by the respective issuer, or any affiliate, or partner thereof (“Issuer”). All potential investors must read the PPM and no person may invest without acknowledging receipt and complete review of the PPM. With respect to the “targeted” goals and performance levels outlined herein, these do not constitute a promise of performance, nor is there any assurance that the investment objectives of any program will be attained. These “targeted” factors are based upon reasonable assumptions more fully outlined in the Offering Documents/ PPM. Consult the PPM for investment conditions, risk factors, minimum requirements, fees and expenses and other pertinent information with respect to any investment. These investment opportunities have not been registered under the Securities Act of 1933 and are being offered pursuant to an exemption therefrom and from applicable state securities laws. Past performance are no guarantee of future results. All information is subject to change. You should always consult a tax professional prior to investing. Investment offerings and investment decisions may only be made on the basis of a confidential private placement memorandum issued by Issuer, or one of its partner/issuers. Issuer does not warrant the accuracy or completeness of the information contained herein. Thank you for your cooperation.

Securities offered through Emerson Equity, LLC Member: FINRA, SIPC (CRD#: 130032/SEC#: 801-71293,8-66296). Only available in states where Emerson Equity, LLC is registered. Emerson Equity, LLC is not affiliated with any other entities identified in this communication.

For more information, read our Disclosures & Disclaimers and Terms of Use.

1031 Risk Disclosure:

- There is no guarantee that any strategy will be successful or achieve investment objectives;

- Potential for property value loss – All real estate investments have the potential to lose value during the life of the investments;

- Change of tax status – The income stream and depreciation schedule for any investment property may affect the property owner’s income bracket and/or tax status. An unfavorable tax ruling may cancel deferral of capital gains and result in immediate tax liabilities;

- Potential for foreclosure – All financed real estate investments have potential for foreclosure;

- Illiquidity – Because 1031 exchanges are commonly offered through private placement offerings and are illiquid securities. There is no secondary market for these investments;

- Reduction or Elimination of Monthly Cash Flow Distributions – Like any investment in real estate, if a property unexpectedly loses tenants or sustains substantial damage, there is potential for suspension of cash flow distributions;

- Impact of fees/expenses – Costs associated with the transaction may impact investors’ returns and may outweigh the tax benefits.