So, you think you are ready to sell your property, but you don’t want to pay capital gains tax. You’ve thought about doing a 1031 exchange but have never done one before and do not completely understand the rules of a 1031 exchange.

If this sounds like you, you’re not alone. There are specific requirements for identifying and acquiring like-kind replacement properties for your exchange. A 1031 exchange can seem complicated at first, but with the right guidance the rules themselves are simple to follow.

In this article we’ll cover the important rules of a 1031 exchange across three categories, including:

- Replacement Rules

- Identification Methods

- Timelines

Replacement Rules

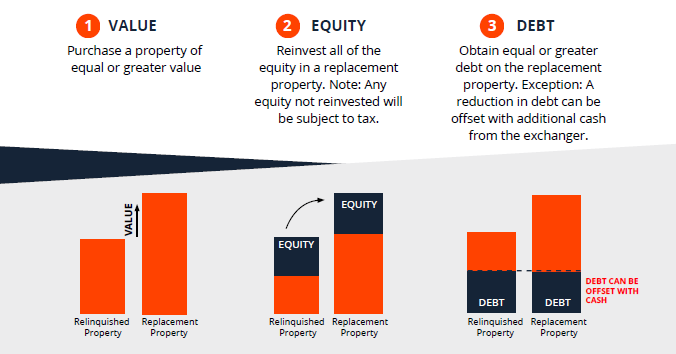

Since a 1031 exchange’s benefit comes from its ability to help you defer paying capital gains tax on your real estate investment, it makes sense that there are rules surrounding the value, equity and debt in the transaction. For the 1031 exchange to work as it is designed, in most cases you’ll want to purchase a property of equal or greater value than the one you are selling. This difference in value is what will allow you to grow your portfolio and “trade up,” which is usually what you are trying to accomplish when using a 1031 exchange. Trading into a property with a higher value is also what allows the rules surrounding your equity to work correctly. To avoid paying any capital gains tax on the transaction, you must reinvest all the equity from the relinquished property directly into the new property. If there is equity left over (boot) that is not reinvested, that amount is taxed.

For example, say you had $100,000 of equity in your previous property. If you contribute the full $100,000 towards the purchase of a new property, you will have avoided paying any capital gains tax. However, if for some reason you are only able to contribute $70,000, you will be taxed on the $30,000 that is left over.

Of course, most real estate transactions aren’t done completely with equity, so you’ll likely also need to understand the rules surrounding debt. Similar to how it’s recommended to reinvest the same amount of equity into the transaction, you’ll also want to obtain an equal or greater amount of debt on the replacement property. The only exception to this rule is that a reduction in the amount of debt can be offset with additional equity.

For example, if the amount of debt on your original property was $200,000, you’ll need to obtain at least that amount of debt on the replacement property. If you can only obtain $150,000, you can contribute an additional $50,000 in cash to offset the difference.

Identification Methods

If you’ve read our article on how a 1031 exchange works, you know that the identification period has strict deadlines that must be followed. To meet those deadlines, it’s important to understand the rules surrounding identifying replacement properties.

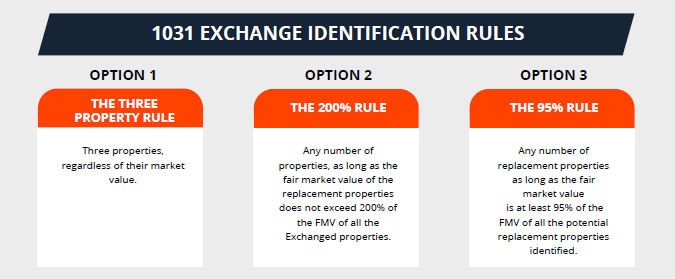

THREE (3) PROPERTY RULE

There are three ways to identify a replacement property, the most common way being the three-property rule. As the name suggests, this rule allows you to identify up to three (3) properties during the identification period, regardless of their market value. Once the identification period is over, these will be the properties that you are allowed to purchase as a part of the 1031 exchange.

The Three Property Rule is the preferred strategy used by 1031 exchangers.

200% RULE

This rule allows you to identify any number of properties, as long as their total (aggregate) fair market value (FMV) of all identified properties does not exceed 200% of the FMV of the total (aggregate) net sales value of the property(s) you are selling.

For example, if the value of the property you are selling is $100,000, under this rule you would be allowed to identify up to $200,000 (200%) of replacement properties. This rule is commonly preferred by investors wishing to diversify their portfolio.

If you aim to diversify your investment portfolio and plan on acquiring four or more properties, the Three Property Rule will not be enough. Moreover, if you are uncertain about your preferences for a replacement property, you can select several properties (with fair market values within the 200% allowance) and then take extra time to decide.

For those who wish to diversify their portfolios identifying more than 3 properties, the 200% rule is preferred.

95% RULE

The third method is the 95% rule. Under this rule, you are allowed to identify any number of replacement properties so long as the FMV of the properties you purchase by the end of the 1031 exchange have a value of at least 95% of the FMV of all the properties you identified.

For example, if the total FMV of all the properties you identified is $200,000, you must purchase at least $190,000 worth of property for the 1031 exchange to be conducted successfully. This rule is typically used when both the three-property rule and the 200% rule fail to meet the investor’s needs.

Investors may have a need to identify more than three properties and more than 200% of the sales value of the relinquished property. In this case, the 95% rule is best.

Remember, if you do not acquire and close on at least 95% of the value of the identified like-kind replacement properties, the entire 1031 exchange transaction will be disallowed.

Timelines

If you’ve read our article on how a 1031 exchange works, you know that the identification period has strict deadlines that must be followed. To meet those deadlines, it’s important to understand the rules surrounding identifying replacement properties.

45-Day Identification Rule

Once the sale of your property is complete, the identification period of the 1031 exchange process begins. This period is relatively short and has a strict timeline that will prevent you from completing a successful exchange if not met.

You have 45 days after the sale of your property to identify a suitable replacement property (or properties) that qualify under the like-kind requirement. This 45-day period starts the day after the sale closes and includes all calendar days, including weekends and holidays.

For example, if you sell your property on June 1st, you will have until July 16th to identify a replacement.

180-Day Close Rule

After identifying a suitable replacement property, the next important step is to complete a purchase. You have 180 days after the sale of your original property to close on a new one, so time is again of the essence in this stage. If it takes you the full 45 days to identify a suitable property during the identification period, you will have 135 days left to close.

At closing, the QI will release the funds they have been holding in escrow from the sale of your relinquished property. If you are purchasing multiple properties, you may have multiple closings, so long as they all fall within the 180-day window.

After the closing is complete, not only will you now be the owner of a new property and have successfully completed your 1031 exchange, but you will have deferred some or all of the capital gains tax you normally would have had to pay.

Things to Note:

- There are no extensions for the weekends or holidays that fall within your identification period.

- 1031 exchange language must be written in the sales contract when selling your property outlining the QI which whom the funds will be sent to upon closing.

- Exchangers must never take constructive receipt of the sales proceeds to qualify for a valid 1031 exchange.

- Replacement properties that you are considering must be sent to your Qualified Intermediary (“QI”) and identified no later than midnight of the 45th calendar day

- If 1031 exchange investors do not identify within the 45-day ID period, the 1031 exchange becomes disqualified.

- Identified properties must be acquired within 180 days following the close of the relinquished property to qualify for a valid 1031 exchange.

- following the close of your relinquished property sale transaction.

- Only properties sent to the Q.I. for ID will qualify for 1031 exchange.

- A Qualified Intermediary (QI) must provide a written and signed document that describes the properties you wish to identify including legal description, street address, or name of property or DST (if applicable).

- If you wish to revoke a replacement property recently identified, you must provide a written and signed document that describes the property that you wish to remove from the list of identified properties.

Conclusion

We hope this article has given you an overview of important rules surrounding a 1031 exchange. Although a 1031 exchange can be more complicated than a traditional property purchase, the potential benefits may outweigh the extra effort required.

For investors who are challenged with the strict 45 and 180-day 1031 timelines, our Delaware Statutory Trusts (DST) properties can be a potential viable alternative. DST properties are typically pre-financed and pre-closed, helping alleviate the strict 1031 timelines. We also recommend identifying at least one DST property as a 1031 exchange backup in the event exchangers cannot find suitable replacement properties or need a fallback. Browse our 1031 exchange approved properties today.

Be sure to visit our resources section to learn more about DSTs and 1031 exchanges. For more information, schedule a consultation with an advisor or contact us today.

Join Exchange-X! Click the link above to create an account now and be the first to know about upcoming opportunities.

Download your free copy of “The Power of 1031 Exchanges and Delaware Statutory Trusts (DSTs)” to learn more about how Delaware Statutory Trusts (DST) can complement your portfolio.