Interested in doing a 1031 exchange but not sure how it works? If so, you aren’t alone. A 1031 exchange could be a powerful tool available to real estate investors but can also seem complicated if you are doing one for the first time.

In this article, we break down how a 1031 exchange works by looking at the three 1031 exchange phases, including:

- Before the sale

- Identification period

- Closing

Before the Sale

Before you initiate a 1031 exchange, you need to confirm the property that you currently own and the one you intend to purchase will qualify as “like-kind” property. We’ve written a separate article that goes into detail on the like-kind property requirements and the types of property that qualify, so give that a read if you are not sure.

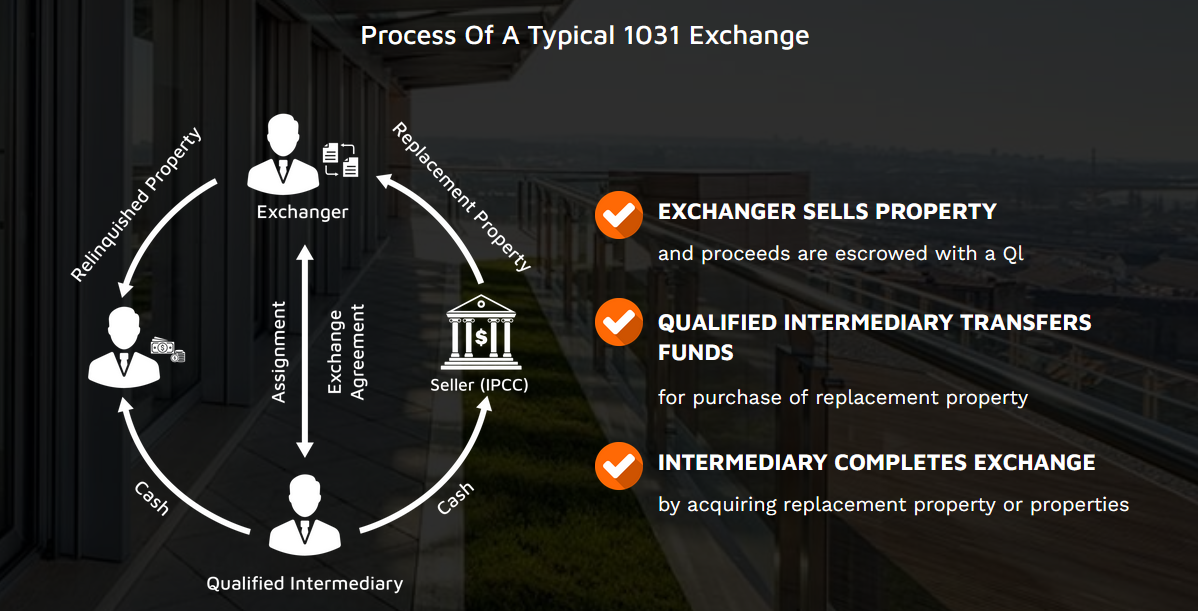

Another important step you’ll want to take before you sell your property is to find a 1031 exchange qualified intermediary (QI). The Qualified Intermediary, also known as the “QI” will hold the funds from the sale during the course of the 1031 exchange and will also be the person you notify when you’ve identified the replacement property you wish to purchase. The QI will be entrusted with holding a significant amount of money for an extended period of time, so do your research and find a QI you can trust.

Lastly, time is of the essence in a 1031 exchange, which is why we recommend starting your search for a replacement property before the clock starts counting down. You don’t have to commit to anything at this stage, but having a few properties lined up prior to the sale can give you extra peace of mind.

Of course, it’s not a requirement to take any of these steps prior to selling your property and initiating the 1031 exchange process, but it’s in your best interest and will help the rest of the process run smoothly.

Remember, you must include 1031 exchange language into the final sales contract for a 1031 exchange to be valid upon closing. The seller must also never take possession of the sales proceeds in order to successfully exchange.

We recommend you read our blog titled, “5 Steps to Take Before Your 1031 Exchange” for more information.

Identification Period

45-Day Identification Rule

Once the sale of your property is complete, the identification period of the 1031 exchange process begins. This period is relatively short and has a strict timeline that will prevent you from completing a successful exchange if not met.

You have 45 days after the sale of your property to identify a suitable replacement property (or properties) that qualify under the like-kind requirement. This 45-day period starts the day after the sale closes and includes all calendar days, including weekends and holidays. For example, if you sell your property on June 1st, you will have until July 16th to identify a replacement.

During this period, you will notify your QI of the properties you have selected. Once the 45 days is over you will only be allowed to purchase the properties you have identified. In most cases you can identify up to three properties, so choose wisely and select properties that not only meet your investment criteria, but that you feel confident will close.

It’s important to keep in mind, only the full equity proceeds from the relinquished property used to purchase the replacement property will be exempt from capital gains tax under IRC 1031 exchange rules. If the property you purchase costs less than the total funds you received from the sale of your original property, the amount left over is taxed. This is why most investors will try to identify properties of the same or greater value than the one they sold.

This short, strict timeline with specific requirements during the identification period is why we recommend starting your search for a replacement property before you officially start the 1031 exchange process. If you are unable to identify suitable replacement properties during this period, the 1031 exchange will not be possible.

Read our blog titled “1031 Exchange Identification Rules Explained” for more info.

Closing

180-Day Closing Deadline

After identifying a suitable replacement property, the next important step is to complete a purchase. You have 180 days after the sale of your original property to close on a new one, so time is again of the essence in this stage. If it takes you the full 45 days to identify a suitable property during the identification period, you will have 135 days left to close.

At closing, the QI will release the funds they have been holding in escrow from the sale of your relinquished property. If you are purchasing multiple properties, you may have multiple closings, so long as they all fall within the 180-day window.

After the closing is complete, not only will you now be the owner of a new property and have successfully completed your 1031 exchange, but you will have deferred some or all of the capital gains tax you normally would have had to pay.

Conclusion

We hope this article gave you a good understanding of how a 1031 exchange works and the steps you can expect to take place during the process. While a 1031 exchange is a relatively simple process in terms of the number of steps, it can also be a complicated process with several strict requirements and timelines that must be met.

Our team at Exchange-X can help you navigate the 1031 exchange process to help ensure a successful exchange. If you are looking for replacement properties to satisfy an exchange, or have any additional questions about the process, schedule a consultation with an advisor or contact us today.

Join Exchange-X. Click the link above to create an account now and be the first to know about upcoming opportunities.

Download your free copy of “The Power of 1031 Exchanges and Delaware Statutory Trusts (DSTs)” to learn more about how Delaware Statutory Trusts (DST) can complement your portfolio.