If you are a real estate investor, there’s a good chance you will need to sell a property at some point. Typically doing so would result in having to pay capital gains tax on your investment, but that doesn’t have to be the case. By utilizing a 1031 exchange, you can defer capital gains taxes on the sale of your property.

In this article we go over the basics of a 1031 exchange and answer the following questions:

- What is a 1031 exchange?

- How does a 1031 exchange work?

- What qualifies for a 1031 exchange?

What is a 1031 Exchange?

A 1031 exchange is arguably the most valuable tax advantage available to real property owners. Stemming from section 1031 of the Internal Revenue Code, a 1031 exchange allows a property owner to defer paying capital gains and depreciation recapture tax on the sale of their property by investing the proceeds into a “like-kind” property.

The United States Internal Revenue Code Section 1031(a) reads as follows:

In General – No gain or loss shall be recognized on the exchange of property held for productive use in a trade or business or for investment if such property is exchanged solely for property of like kind which is to be held either for productive use in a trade or business or for investment.

Exception – this subsection shall not apply to any exchange of:

- Stock in trade or other property held primarily for sale

- Stock, bonds, or notes

- Other securities or evidence of indebtedness or interest

- Interest in a partnership

- Certificates of trust or beneficial interests

- Chooses in action

For example, an investor purchased a property five years ago for $100,000 and sells it today for $300,000 net of closing costs. Because there is a capital gain of $200,000 from the sale of the property, that amount will be subject to capital gains tax. However, if the investor uses a 1031 exchange to purchase another property, they can defer paying the capital gains tax. This would allow the exchanger to utilize the buying power of the full $300,000 (less any transaction fees not accounted for in this simplified example), which is why a 1031 exchange is such a powerful tool.

There are pros and cons to a 1031 exchange, and it may not always be the right option for every situation. Our experienced team at Exchange-X can answer any questions you have and help decide if a 1031 exchange is right for you.

How Does a 1031 Exchange Work?

As outlined above, a 1031 tax-deferred exchange can be a powerful wealth-building tool, however, to complete a successful 1031 exchange, there are a set of strict rules and timelines you must follow. Following them correctly will allow you to defer capital gains and depreciation recapture taxes but doing them incorrectly can result in an unwanted tax bill. Let’s highlight some steps in order to ensure a successful 1031 exchange.

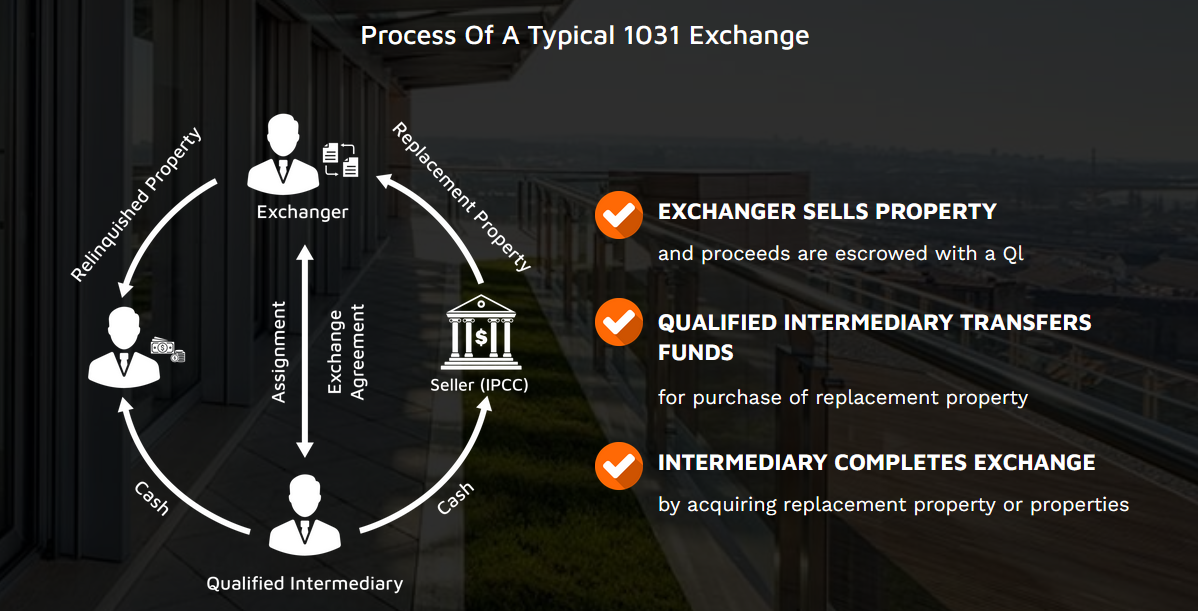

Step one is to contact a 1031 Qualified Intermediary (QI) and open escrow. A 1031 QI is the intermediary responsible to hold the escrowed funds until the 1031 exchange is complete. The QI will be entrusted with holding a significant amount of money for an extended period, of time, so take extra care to select a QI that you trust.

Once an escrow account has been established with the Qualified Intermediary, the next step is to list and sell the property with a trusted commercial real estate broker. We advise to work closely with your QI during this time as it may take several months to sell a property.

Lastly, the exchanger must identify and close the replacement property(s). Per IRS rules, an exchanger is granted 45-days to identify the replacement property(s) and 180-days to close on the property(s). When you have identified the replacement property(s) and are ready to close, the QI will release the funds for closing allow you to acquire the new property. This step ensures the exchanger never takes constructive receipt of the proceeds and all funds are directed to the closing agent.

At this point you will have successfully completed the 1031 exchange.

There are several caveats and specifics to this process that are beyond the scope of this article, so we recommend you consult with a 1031 expert before entering into the process.

What Qualifies for a 1031 Exchange?

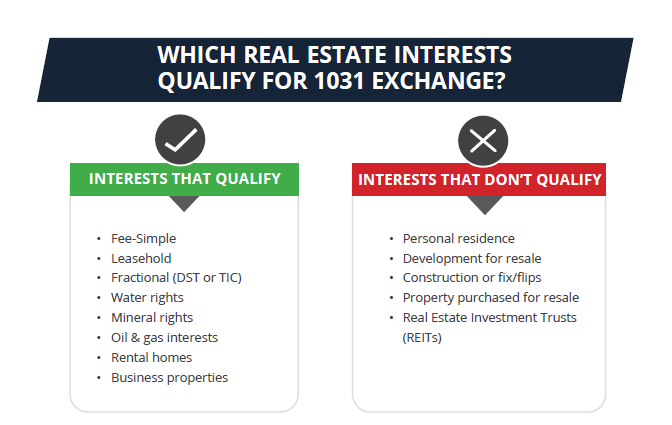

In addition to the stringent rules and timelines required by the IRS for a 1031 exchange, the relinquished property you are selling and the replacement property you are buying must be considered “like-kind”.

A lot of people assume that like-kind property means if you sell an office building you can only buy another office building, or that an apartment complex can only get you another apartment complex. However, this is not the case. The like-kind requirement simply means that you must exchange one form of real property for another.

In general, office buildings, warehouses, retail centers, land, multifamily and single-family rentals will all qualify for a 1031 exchange. Even more obscure assets like mineral, water or air rights can qualify, as well as easements and development rights.

For a full breakdown on what types of properties qualify, read our article on what qualifies for a 1031 exchange.

Conclusion

We hope this article helped shed some light on the basics of 1031 exchanges is and how to utilize on as a part of your real estate investment wealth building strategy. Although the process can be complicated and there are strict timelines to follow, having the opportunity to defer capital gains taxes is well worth the effort.

Of course, there are many specific details we were not able to cover in this article, so do your research and consult with experts before jumping into the process.

If you are ready to start a 1031 exchange, or have additional questions, schedule a consultation with one of our experts at Exchange-X.

To learn more about how 1031 exchanges and Delaware Statutory Trusts (DST) can complement your portfolio, visit our website for additional resources.

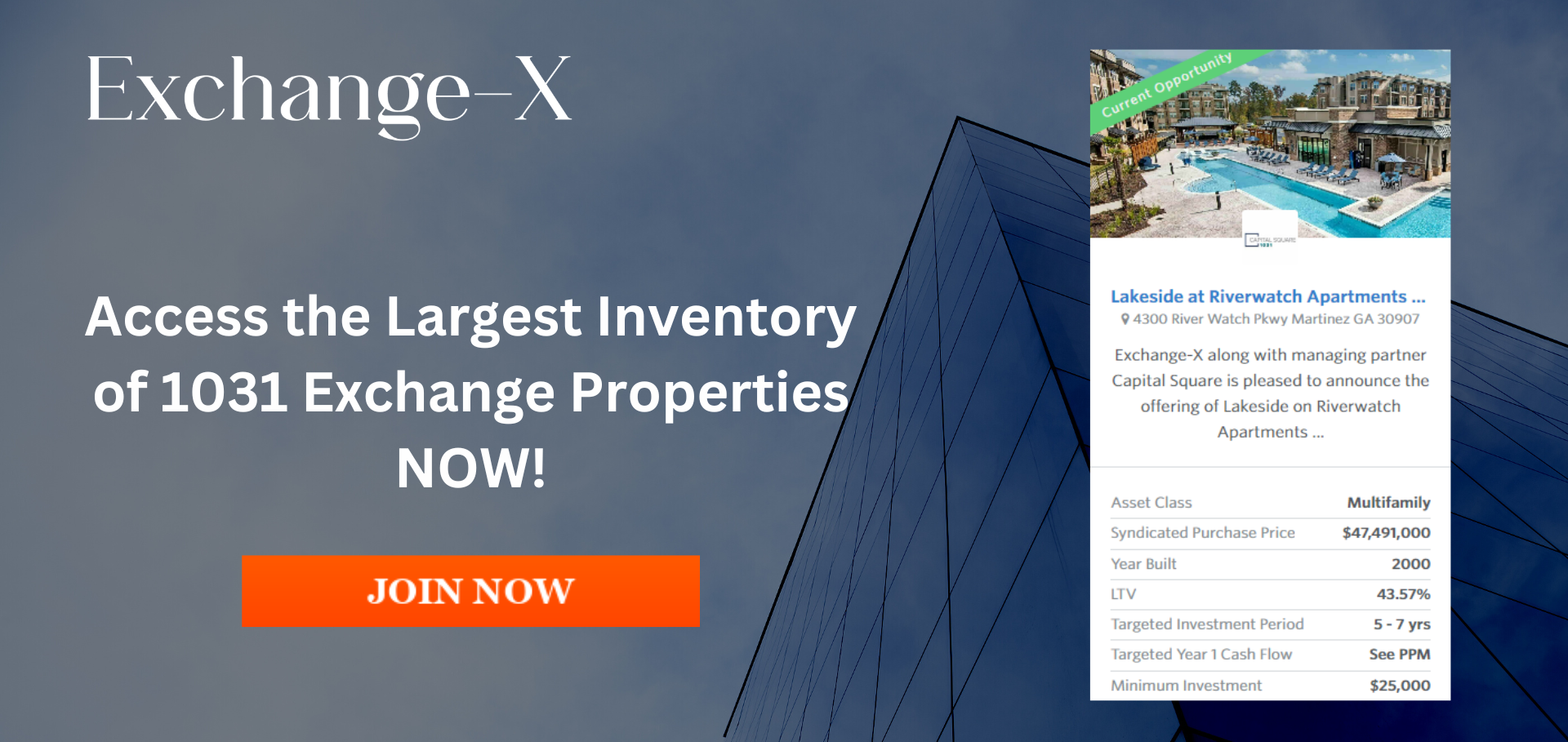

Join Exchange-X! Click the link above to create an account now and be the first to know about upcoming opportunities.

Download your free copy of “The Power of 1031 Exchanges and Delaware Statutory Trusts (DSTs)” to learn more about how Delaware Statutory Trusts (DST) can complement your portfolio.

Full Disclaimer Copyright 2023 Exchange-X, LLC. All rights reserved.

The contents of this communication: (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, (ii) offers can be made only by the confidential Private Placement Memorandum (the “PPM”) which is available upon request, (iii) do not and cannot replace the PPM and is qualified in its entirety by the PPM, and (iv) may not be relied upon in making an investment decision related to any investment offering by the respective issuer, or any affiliate, or partner thereof (“Issuer”). All potential investors must read the PPM and no person may invest without acknowledging receipt and complete review of the PPM. With respect to the “targeted” goals and performance levels outlined herein, these do not constitute a promise of performance, nor is there any assurance that the investment objectives of any program will be attained. These “targeted” factors are based upon reasonable assumptions more fully outlined in the Offering Documents/ PPM. Consult the PPM for investment conditions, risk factors, minimum requirements, fees and expenses and other pertinent information with respect to any investment. These investment opportunities have not been registered under the Securities Act of 1933 and are being offered pursuant to an exemption therefrom and from applicable state securities laws. Past performance are no guarantee of future results. All information is subject to change. You should always consult a tax professional prior to investing. Investment offerings and investment decisions may only be made on the basis of a confidential private placement memorandum issued by Issuer, or one of its partner/issuers. Issuer does not warrant the accuracy or completeness of the information contained herein. Thank you for your cooperation.

Securities offered through Emerson Equity, LLC Member: FINRA, SIPC (CRD#: 130032/SEC#: 801-71293,8-66296). Only available in states where Emerson Equity, LLC is registered. Emerson Equity, LLC is not affiliated with any other entities identified in this communication.

For more information, read our Disclosures & Disclaimers and Terms of Use.

1031 Risk Disclosure:

- There is no guarantee that any strategy will be successful or achieve investment objectives;

- Potential for property value loss – All real estate investments have the potential to lose value during the life of the investments;

- Change of tax status – The income stream and depreciation schedule for any investment property may affect the property owner’s income bracket and/or tax status. An unfavorable tax ruling may cancel deferral of capital gains and result in immediate tax liabilities;

- Potential for foreclosure – All financed real estate investments have potential for foreclosure;

- Illiquidity – Because 1031 exchanges are commonly offered through private placement offerings and are illiquid securities. There is no secondary market for these investments;

- Reduction or Elimination of Monthly Cash Flow Distributions – Like any investment in real estate, if a property unexpectedly loses tenants or sustains substantial damage, there is potential for suspension of cash flow distributions;

- Impact of fees/expenses – Costs associated with the transaction may impact investors’ returns and may outweigh the tax benefits.