For investors who are considering or in the process of using a 1031 exchange, there can be many challenges associated with successfully closing.

A few of these challenges today involve:

- Ability to source, identify, analyze, inspect and value replacement properties

- Ability to secure financing

- Ability to secure an appraisal at a sufficient value

- Ability to successfully 1031 exchange within the 45-day identification & 180-day closing timelines

- Overpaying in a competitive market

- Seller gets cold feet

In this article we are going to discuss the basics of 1031 exchange timelines and ways to increase the chances of a successful exchange including:

- What are the 45-day & 180-day Timelines?

- What is 1031 Exchange Backup?

- Using a Delaware Statutory Trust (DST) as 1031 Exchange Backup

- Online Identification Tools

What are the 45 & 180-day Timelines?

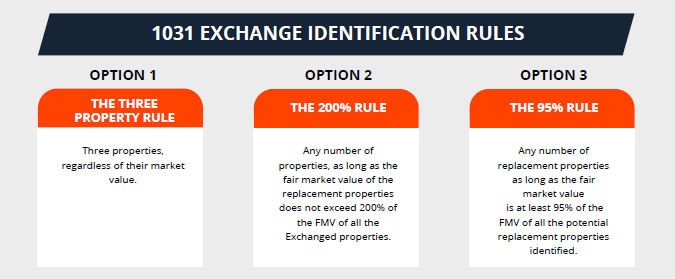

Within the IRC 1031 tax code, there are two major timelines the IRS implemented which allows an investor to exchange a “like-kind” property for another.

45-Day Identification Period

Upon selling the relinquished property, a 1031 investor has 45 calendar days to identify potential replacement properties to purchase. After the 45-day ID period, these properties must be closed upon to complete the exchange, or the exchange will fail. All identifications are completed with a Qualified Intermediary (QI).

180-Day Closing Period

Upon selling the relinquished property, a 1031 investor has 180 calendar days from the date of sale to close the replacement properties previously identified. Replacement properties must be received and completed no later than the earlier of; 180-days after transfer of the exchanged property, or the due date of the income tax return (including extensions for tax year in which the relinquished property was transferred).

Read The 1031 Exchange Process Explained to learn more.

What is 1031 Exchange Backup?

1031 Exchange “backup” is a term used to ensure an exchanger has a property or several properties to fall back on in the event a complication occurs on a property previously Identified. Once an investor is past the 45-day ID period, there is no way to alter the Identified properties.

For example, an exchanger uses The Three Property Rule and IDs all 3 properties allowed. It is now day 46 and his first property identified was outbid by another buyer. The exchanger now has 2 additional backup properties as insurance in the event he failed to close on the first property.

Using a Delaware Statutory Trust (DST) as 1031 Exchange Backup

There are several features the DST can provide investors that a traditional property exchange cannot. These main features include:

- Quick Close: No need to source and conduct due diligence on replacement properties. The DST property is already pre-vetted and closed.

- Pre-Financed: No need to secure financing. The DST property is pre-financed, and loans are non-recourse to investors.

- Pre-Leased: No need to secure new or existing tenants since the leasing responsibility is held by best-in-class property management already in place.

For a full list of potential DST benefits, consider reading our article “10 Potential Advantages of Owning a Delaware Statutory Trust (DST)“.

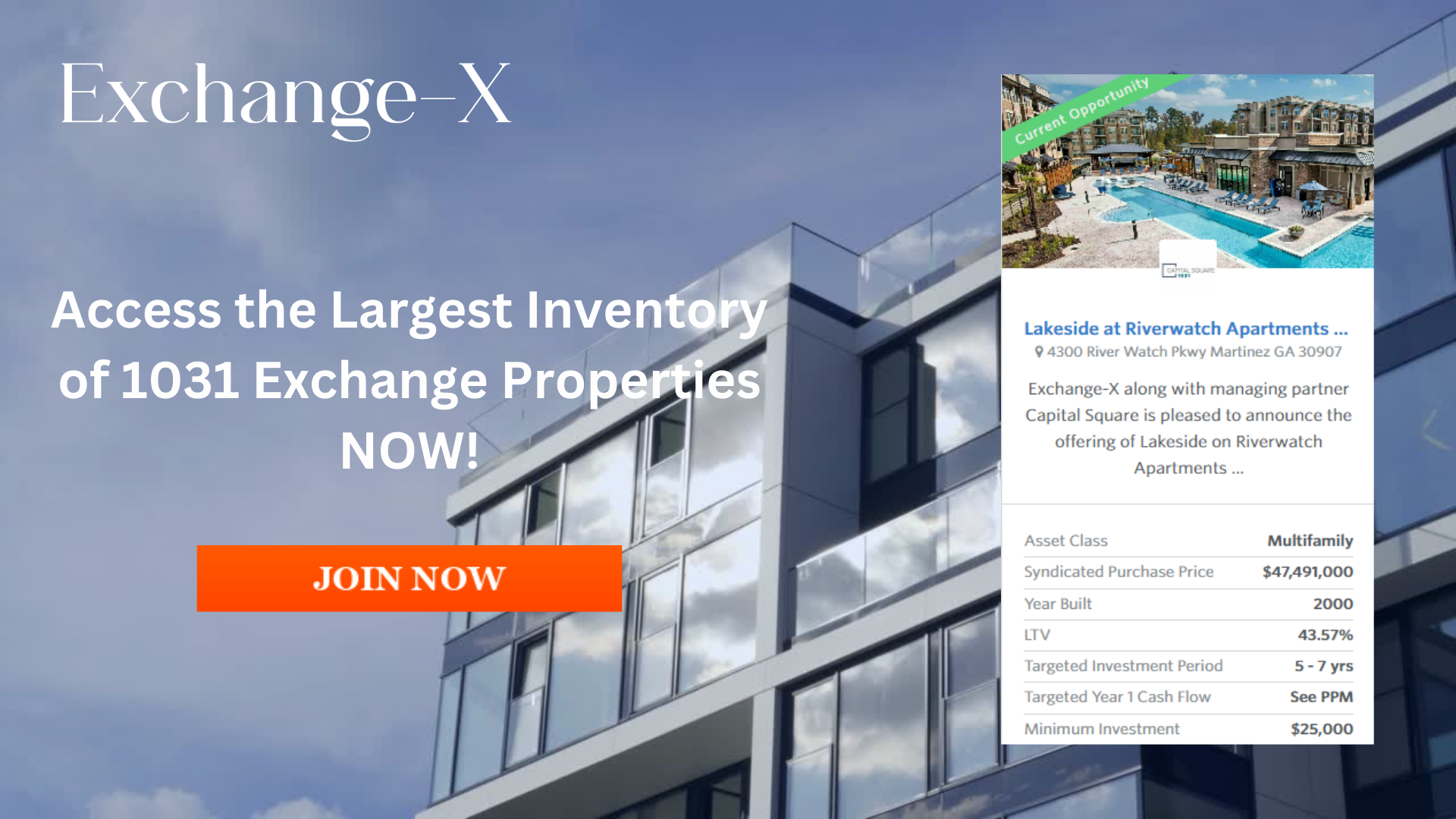

Online Identification Tools

Get the backup insurance you need. Take action by identifying a DST property as backup for your 1031 identification period. Our state-of-the-art DST platform makes 1031 identification simple.

Join Exchange-X today.

Conclusion

The IRS has placed strict timelines for 1031 exchangers to abide by. These timelines include 45-day identification & 180-day closing periods. Meeting these deadlines can be extremely stressful and can sometimes lead to a failed exchanged if not handled correctly.

A Delaware Statutory Trust (DST) can potentially be one of the most powerful tools used today to successfully complete an exchange. A DST can offer the flexibility of closing quickly and alleviate the burden of securing financing from lenders.

Since most DSTs are fully stabilized, investors can rely on best-in-class property management to handle all leasing efforts for simple, turnkey ownership. By identifying a DST property as a backup, an investor can gain the confidence to successfully close his exchange by eliminating most issues associated with a traditional exchange.

Get the backup you need with Exchange-X, the leading DST investment platform with access to dozens of institutional grade replacement properties to choose from.

For more information, schedule a consultation with one of our experts or call 888-495-7355 today.

To learn more about how 1031 exchanges and Delaware Statutory Trusts (DST) can complement your portfolio, visit our Resource Center.

Join Exchange-X! Click the link above to create an account now and be the first to know about upcoming opportunities.

Download your free copy of “The Power of 1031 Exchanges and Delaware Statutory Trusts (DSTs)” to learn more about how Delaware Statutory Trusts (DST) can complement your portfolio.

Full Disclaimer Copyright 2023 Exchange-X, LLC. All rights reserved.

The contents of this communication: (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, (ii) offers can be made only by the confidential Private Placement Memorandum (the “PPM”) which is available upon request, (iii) do not and cannot replace the PPM and is qualified in its entirety by the PPM, and (iv) may not be relied upon in making an investment decision related to any investment offering by the respective issuer, or any affiliate, or partner thereof (“Issuer”). All potential investors must read the PPM and no person may invest without acknowledging receipt and complete review of the PPM. With respect to the “targeted” goals and performance levels outlined herein, these do not constitute a promise of performance, nor is there any assurance that the investment objectives of any program will be attained. These “targeted” factors are based upon reasonable assumptions more fully outlined in the Offering Documents/ PPM. Consult the PPM for investment conditions, risk factors, minimum requirements, fees and expenses and other pertinent information with respect to any investment. These investment opportunities have not been registered under the Securities Act of 1933 and are being offered pursuant to an exemption therefrom and from applicable state securities laws. Past performance are no guarantee of future results. All information is subject to change. You should always consult a tax professional prior to investing. Investment offerings and investment decisions may only be made on the basis of a confidential private placement memorandum issued by Issuer, or one of its partner/issuers. Issuer does not warrant the accuracy or completeness of the information contained herein. Thank you for your cooperation.

Securities offered through Emerson Equity, LLC Member: FINRA, SIPC (CRD#: 130032/SEC#: 801-71293,8-66296). Only available in states where Emerson Equity, LLC is registered. Emerson Equity, LLC is not affiliated with any other entities identified in this communication.

For more information, read our Disclosures & Disclaimers and Terms of Use.

1031 Risk Disclosure:

- There is no guarantee that any strategy will be successful or achieve investment objectives;

- Potential for property value loss – All real estate investments have the potential to lose value during the life of the investments;

- Change of tax status – The income stream and depreciation schedule for any investment property may affect the property owner’s income bracket and/or tax status. An unfavorable tax ruling may cancel deferral of capital gains and result in immediate tax liabilities;

- Potential for foreclosure – All financed real estate investments have potential for foreclosure;

- Illiquidity – Because 1031 exchanges are commonly offered through private placement offerings and are illiquid securities. There is no secondary market for these investments;

- Reduction or Elimination of Monthly Cash Flow Distributions – Like any investment in real estate, if a property unexpectedly loses tenants or sustains substantial damage, there is potential for suspension of cash flow distributions;

- Impact of fees/expenses – Costs associated with the transaction may impact investors’ returns and may outweigh the tax benefits.