A Delaware Statutory Trust or DST is a legal entity created under Delaware Law that permits fractional ownership of real estate assets. Real estate held within a DST is eligible for 1031 exchange as long as the property complies with the requirements of IRS Revenue Ruling 2004-2086.

There are several potential benefits to owning a Delaware Statutory Trust (DST), the most important being diversification and passive ownership. Lower investment minimums within a DST allow a single investor access to institutional property ownership.

Potential advantages of owning a Delaware Statutory Trust (DST) include:

- 1031 Exchange Simplicity and Flexibility

- Access to Institutional-Quality Real Estate

- Passive ownership through Professional Property & Asset Management

- Diversification

- Ability to Close Quickly & with Certainty

- 1031 Identification & Boot Backup

- Low Minimum Investments

- Non-Recourse Debt

- Tax Optimization

- Simple Tax Reporting

1031 Exchange Simplicity and Flexibility

Delaware Statutory Trust (DST) properties by nature are pre-vetted, pre-financed, pre-closed and investment ready. No more anxiety surrounding failed 1031 exchanges or contacts falling through. Investors can exchange with confidence knowing they have options.

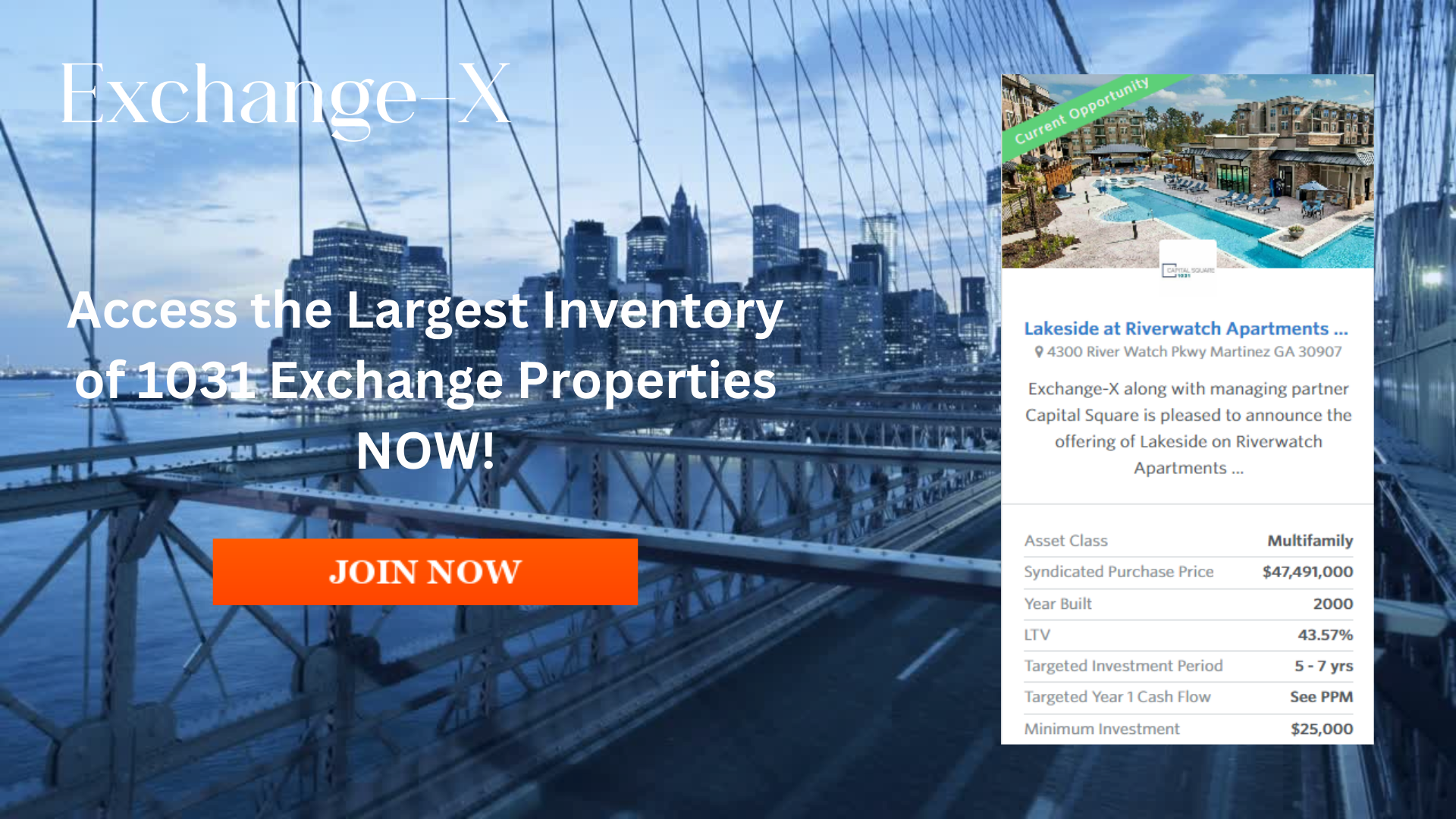

At Exchange-X, we make 1031 exchanges simple. Sign up to our free state-of-the-art Delaware Statutory Trust (DST) Marketplace for a complete list of available 1031 eligible replacement properties. Members can easily view active offerings, analyze property details, download due diligence documents and more.

Access to Institutional-Quality Real Estate

Delaware Statutory Trust (DST) properties are structured by leading real estate investment and development sponsors with extensive track records. These properties are typically stabilized, new construction complexes in desirable, high barrier to entry markets.

Passive ownership through Professional Property & Asset Management

Investors can enjoy the many potential benefits of owning real estate passively without ongoing management responsibilities. DSTs are operated by seasoned asset managers that handle all aspects of management including market analysis, local architectural, zoning & building boards, contractors for rehab/development, inspections, leasing, financing & closing, and much more.

Diversification

Investors can easily diversify their real estate portfolio by acquiring beneficial interests of DST properties throughout various geographical locations, property types, asset classes, tenant profiles, sponsors and more

Ability to Close Quickly & with Certainty

DST investors have full control with due diligence documents at their fingertips. This gives investors the advantage to close escrow quickly and with certainty. This can be beneficial when faced with strict 1031 Exchange timelines to follow.

1031 Identification & Boot Backup

1031 Identification Backup

With strict 1031 exchange 45-day ID periods, a DST can serve as backup insurance in the event a property previously identified is no longer available or falls through.

Read Using a DST as 1031 Exchange Backup to learn more.

Leftover “Boot” Backup

A 1031 exchange replacement property must be purchased at or above the price of the relinquished property. “Boot” occurs when there is excess equity left over that will be subject to taxation. A DST can be used to place the “excess” equity to work and avoid taxation.

Read What is 1031 Exchange Boot to learn more.

Lower Minimum Investments

Minimum investments as low as $100,000 (25,000 cash), investors have the flexibility to diversify into several different properties throughout country.

Non-Recourse Debt

Since the Delaware Statutory Trust (DST) is the only entity liable for its debts, any mortgage on the property is non-recourse to the limited partners (investors) under the trust. Investors are insulated against any debt on the entity level and are not required to provide personal documentation for loan approval.

Tax Optimization

DSTs offer similar potential tax advantages to traditional real estate ownership including annual depreciation and mortgage interest write offs, as well as the ability to utilize a 721 or 1031 Exchange to defer capital gain taxes. DSTs can also be held within qualified self-directed IRA and 401K retirement accounts, potentially further reducing tax liabilities.

Simple Tax Reporting

DST owners receive a Form 1099 for ordinary income, Form 1098 for mortgage interest write-off, along with an operating statement or profit & loss statement for depreciation.

Conclusion

There is an increasing demand for passive 1031 exchange replacement properties. Owning beneficial interests within a Delaware Statutory Trust (DST) can prove to be a potential advantageous tool for an investor looking to diversify their portfolio with institutional grade real estate without the burden of landlord responsibilities.

By utilizing a DST, an investor can defer capital gains taxes (via the 1031 exchange) while diversifying among multiple geographic locations, property types, asset classes and tenants. A DST also offers the flexibility to close transactions quickly. This is a major advantage when identifying a replacement property to serve as a last-minute solution for an at-risk exchange.

DST interests can be purchased through most Self-Directed IRA and 401k retirement accounts making the DST a great tool for tax deferral and estate planning purposes.

Ready to start a 1031 exchange or have additional questions? Schedule a consultation with one of our experts today.

To learn more about how 1031 exchanges and Delaware Statutory Trusts (DST) can complement your portfolio, visit our Resource Center .

Join Exchange-X! Click the link above to create an account now and be the first to know about upcoming opportunities.

Download your free copy of “The Power of 1031 Exchanges and Delaware Statutory Trusts (DSTs)” to learn more about how Delaware Statutory Trusts (DST) can complement your portfolio.