Any real estate investor who has performed a 1031 exchange understands the intricacies behind successfully completing the “perfect” exchange. The idea behind a 1031 exchange is to cash in on profits, defer capital gain taxes and move your equity into better cash flowing assets. As discussed in previous articles, there are strict 1031 exchange rules and if broken, can lead to heavy tax consequences. One of these rules is the “equal to or greater” rule.

In this article we are going to touch upon two very important tax deferral tools used to compliment a 1031 Exchange including:

- What is 1031 Exchange Boot?

- Types of 1031 Exchange Boot.

- How to Offset 1031 Exchange Boot?

What is 1031 Exchange Boot?

1031 Exchange Boot, commonly referred to as “boot” is an old English term pertaining to “exchange in addition to.” In this case, boot is cash or other property added to an exchange to make the value of the traded good equal.

Because it is difficult to find two “like-kind” properties of identical value to exchange, one party (purchaser) will commonly contribute cash and/or physical property to make the value of the exchange equal to or better.

Types of 1031 Exchange Boot

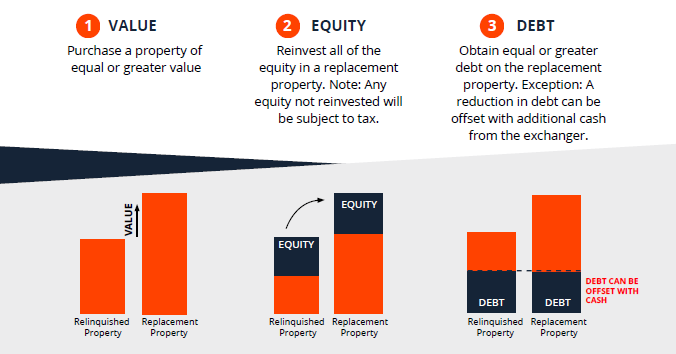

To successfully complete a 1031 Exchange, the purchaser must exchange the relinquished property for an equal or greater amount including value (purchase price), equity and debt.

For example, if you sell a property for $1,000,000 and purchase another for $800,000, the difference in value of $200,000 is referred to as leftover boot. In this scenario, the IRS will recognize the unused proceeds from the relinquished property as taxable boot.

Boot can result from several factors in a real estate investment exchange. Below are the most common types of boot in real estate.

Sales Proceeds

At closing, sales proceeds can create excess boot if they are used to pay non-qualified expenses not considered as closing costs such as service costs. Using sale proceeds for non-transaction related costs are treated as if cash was received from the exchange and used to cover outside costs.

Examples of non-transaction costs include:

- Rent prorations.

- Utility escrow charges.

- Tenant damage deposits to the buyer.

Paying for these items out-of-pocket will avoid turning sale proceeds into boot.

Equity or Cash Boot

When cash received from the relinquished property’s sale is greater than the cash used to purchase the replacement property, you will trigger excess “income” resulting in a taxable event.

For example, if you sell a property for $1,000,000 with $500,000 in equity and $500,000 in debt (50% LTV) and reinvest only $400,000 with $600,000 debt (60%LTV) into the replacement property, the difference of $100,000 in equity is referred to as boot.

In some cases, cash boot can be a result of interest earned from a promissory note or repairs paid for by a seller further credited to the buyer.

Mortgage Boot or Debt Reduction Boot

Mortgage boot or debt reduction boot may occur when the leverage (debt) amount is used on the acquired property is less than the leverage used on the relinquished property. Reducing your debt liability is considered “phantom” income because it is cash once owed that will remain in your pocket at the time the debt matures.

For instance, if your replacement property’s mortgage is $200,000 and your relinquished property’s mortgage was $300,000, then you will have a $100,000 debt reduction boot.

How can I Offset 1031 Exchange Boot?

When creating excess boot, only the net boot amount will be taxable. Excess boot may be offset in several ways including:

- Cash to offset cash boot received at closing.

- Cash to offset debt reduction.

- Debt incurred on replacement property may offset debt reduction boot on the relinquished property.

- Purchase interest in a Delaware Statutory Trust (DST) property with the leftover investment funds

Follow these helpful tips to avoid triggering leftover boot:

- Always trade “across” or up. Never trade down (the “even or up rule”). Trading down always results in boot received, either cash, debt reduction or both. The boot received can be mitigated by exchange expenses paid.

- Bring cash to the closing of the relinquished property to cover charges, which are not transaction costs (see above).

- Do not over-finance replacement property. Financing should be limited to the amount of money necessary to close on the replacement property in addition to exchange funds which will be brought to the replacement property closing.

Conclusion

Although boot does not cancel a 1031 exchange, it may result in a tax liability. The idea behind performing a 1031 exchange is to realize profits, defer taxes and move your equity into a better property.

The 1031 exchange is designed for investors to “trade up” in assets forcing the exchanger to satisfy equal to or greater in value, equity and debt. Trading down will always result in boot received, so aim to trade up or across.

Don’t settle for paying hefty taxes on unused 1031 exchange boot.

Investing in a Delaware Statutory Trust (DST) property is a great option to consider when needing to replace leftover boot funds. A DST allows exchangers to keep their capital working for them while diversifying their portfolio and satisfying the 1031 “trade-up” rules. With low minimum investments, a DST property can be extremely flexible when faced with IRS boot taxes.

If you are ready to start a 1031 exchange, or have additional questions, schedule a consultation with one of our experts at Exchange-X.

To learn more about how 1031 exchanges and Delaware Statutory Trusts (DST) can complement your portfolio, visit our Resource Center.

Always consult with your tax advisor or attorney before embarking on a 1031 exchange to understand how it aligns with your financial situation and investment goals.

Join Exchange-X! Click the link above to create an account now and be the first to know about upcoming opportunities.

Download your free copy of “The Power of 1031 Exchanges and Delaware Statutory Trusts (DSTs)” to learn more about how Delaware Statutory Trusts (DST) can complement your portfolio.

Full Disclaimer Copyright 2023 Exchange-X, LLC. All rights reserved.

The contents of this communication: (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, (ii) offers can be made only by the confidential Private Placement Memorandum (the “PPM”) which is available upon request, (iii) do not and cannot replace the PPM and is qualified in its entirety by the PPM, and (iv) may not be relied upon in making an investment decision related to any investment offering by the respective issuer, or any affiliate, or partner thereof (“Issuer”). All potential investors must read the PPM and no person may invest without acknowledging receipt and complete review of the PPM. With respect to the “targeted” goals and performance levels outlined herein, these do not constitute a promise of performance, nor is there any assurance that the investment objectives of any program will be attained. These “targeted” factors are based upon reasonable assumptions more fully outlined in the Offering Documents/ PPM. Consult the PPM for investment conditions, risk factors, minimum requirements, fees and expenses and other pertinent information with respect to any investment. These investment opportunities have not been registered under the Securities Act of 1933 and are being offered pursuant to an exemption therefrom and from applicable state securities laws. Past performance are no guarantee of future results. All information is subject to change. You should always consult a tax professional prior to investing. Investment offerings and investment decisions may only be made on the basis of a confidential private placement memorandum issued by Issuer, or one of its partner/issuers. Issuer does not warrant the accuracy or completeness of the information contained herein. Thank you for your cooperation.

Securities offered through Emerson Equity, LLC Member: FINRA, SIPC (CRD#: 130032/SEC#: 801-71293,8-66296). Only available in states where Emerson Equity, LLC is registered. Emerson Equity, LLC is not affiliated with any other entities identified in this communication.

For more information, read our Disclosures & Disclaimers and Terms of Use.

1031 Risk Disclosure:

- There is no guarantee that any strategy will be successful or achieve investment objectives;

- Potential for property value loss – All real estate investments have the potential to lose value during the life of the investments;

- Change of tax status – The income stream and depreciation schedule for any investment property may affect the property owner’s income bracket and/or tax status. An unfavorable tax ruling may cancel deferral of capital gains and result in immediate tax liabilities;

- Potential for foreclosure – All financed real estate investments have potential for foreclosure;

- Illiquidity – Because 1031 exchanges are commonly offered through private placement offerings and are illiquid securities. There is no secondary market for these investments;

- Reduction or Elimination of Monthly Cash Flow Distributions – Like any investment in real estate, if a property unexpectedly loses tenants or sustains substantial damage, there is potential for suspension of cash flow distributions;

- Impact of fees/expenses – Costs associated with the transaction may impact investors’ returns and may outweigh the tax benefits.