Real estate investors always seek ways to maximize profits and minimize tax liabilities. One strategy that has gained popularity in recent years is the 1031 exchange. In existence now for over 100 years, the 1031 exchange is viewed as one of the most powerful tax advantages for real estate investors alike.

In this article, we will explore the concept of a 1031 exchange and how it can potentially unlock tax savings and benefit your real estate portfolio including:

- What is a 1031 Exchange?

- Potential Benefits of a 1031 Exchange

- Unlocking Tax Savings: How Does it Work?

- FAQs About 1031 Exchanges

What is a 1031 Exchange?

A 1031 exchange, also known as a like-kind exchange, is a provision in the Internal Revenue Code that allows real estate investors to defer capital gains taxes on the sale of an investment property by reinvesting the proceeds into a similar property. By taking advantage of this provision, investors can effectively postpone their tax obligations and use the funds that would have gone toward taxes to acquire more properties and attempt to grow their real estate portfolio.

Read What is a 1031 Exchange? to learn more.

The Potential Benefits of a 1031 Exchange

A 1031 exchange can offer several potential benefits for real estate investors. Let’s take a closer look at how one can positively impact your financial situation.

Tax Deferral

The primary advantage of a 1031 exchange is the ability to defer capital gains taxes. By reinvesting the proceeds from the sale of an investment property into a like-kind property, investors can defer paying taxes on their gains until they decide to sell the new property.

Increased Cash Flow

By deferring taxes, investors have more funds available to reinvest in additional properties. This increased investment capital can help expand your real estate portfolio and generate the potential for more rental income.

Portfolio Diversification

A 1031 exchange allows investors to diversify their real estate holdings without incurring immediate tax consequences. This flexibility enables investors to adapt to changing market conditions and explore new investment opportunities.

Wealth Accumulation

Over time, the ability to defer taxes and reinvest the proceeds may lead to significant potential wealth accumulation. By continuously leveraging the power of a 1031 exchange, investors have the potential to grow their real estate portfolio and create long-term wealth.

Read Why Consider a 1031 Exchange? and 10 Potential Benefits of Owning a Delaware Statutory Trust (DST) to learn more.

Unlocking Tax Savings: How Does It Work?

To unlock the tax savings potential of a 1031 exchange, there are specific rules and guidelines that investors must follow:

Like-Kind Property

The property you sell and acquire through the exchange must be considered “like-kind.” This means both properties must be held for investment or business purposes and fall within the real estate category.

45-Day Identification Period

After selling the initial property, you have 45 days to identify potential replacement properties. It’s crucial to adhere to this strict timeline to ensure a successful exchange.

180-Day Exchange Period

Once you have identified the replacement properties, you must close on the identified property(s) within 180 days from the initial sale date. This time frame includes both the 45-day identification period and the subsequent 135 days.

Qualified Intermediary (QI)

To facilitate the exchange, you must work with a professional 1031 exchange qualified intermediary. The intermediary plays a vital role in ensuring compliance with IRS regulations and safeguarding the funds throughout the process.

Read our article titled 1031 Exchange Rules Explained and The 1031 Exchange Process Explained learn more.

FAQs About 1031 Exchanges

Q: What are the eligibility criteria for a 1031 exchange?

A: To be eligible for a 1031 exchange, the properties must be held for investment or business purposes. Primary residences and properties held primarily for personal use do not qualify.

Q: Can I exchange a residential property for a commercial property?

A: Yes, you can exchange a residential property for commercial property. Both are considered “like-kind” and qualify for 1031 exchange. The key is that both properties must be held for investment or business purposes.

Q: Are there any time restrictions on how long I must hold the replacement property?

A: No specific time restrictions exist for how long you must hold the replacement property. However, to qualify for another 1031 exchange in the future, it is advisable to have the property for a reasonable period, typically at least one year.

Q: Can I use a 1031 exchange to acquire multiple replacement properties?

A: Yes, you can use a 1031 exchange to acquire multiple replacement properties. However, there are specific rules and limitations regarding the number of properties you can identify and the total value of those properties.

Q: What happens if I receive cash or other property from the exchange?

A: If you receive cash or other property (boot) as part of the exchange, it may be subject to capital gains tax. It’s essential to work closely with your qualified intermediary and tax advisor to understand the tax implications of any boot received.

Q: Can I do a reverse exchange with a 1031 exchange?

A: A reverse exchange is another option available under the 1031 exchange rules. In a reverse trade, the replacement property is acquired first, and the relinquished property is sold afterward.

Q: I already sold my property. Do I still qualify for a 1031 exchange?

A: To successfully complete a 1031 exchange, a Qualified Intermediary (QI) must take “constructive receipt” of the sales proceeds at the time of close. If the sale has occurred and the seller has taken receipt of the proceeds, the exchange is invalid.

Q: How do I identify 1031 exchange replacement properties?

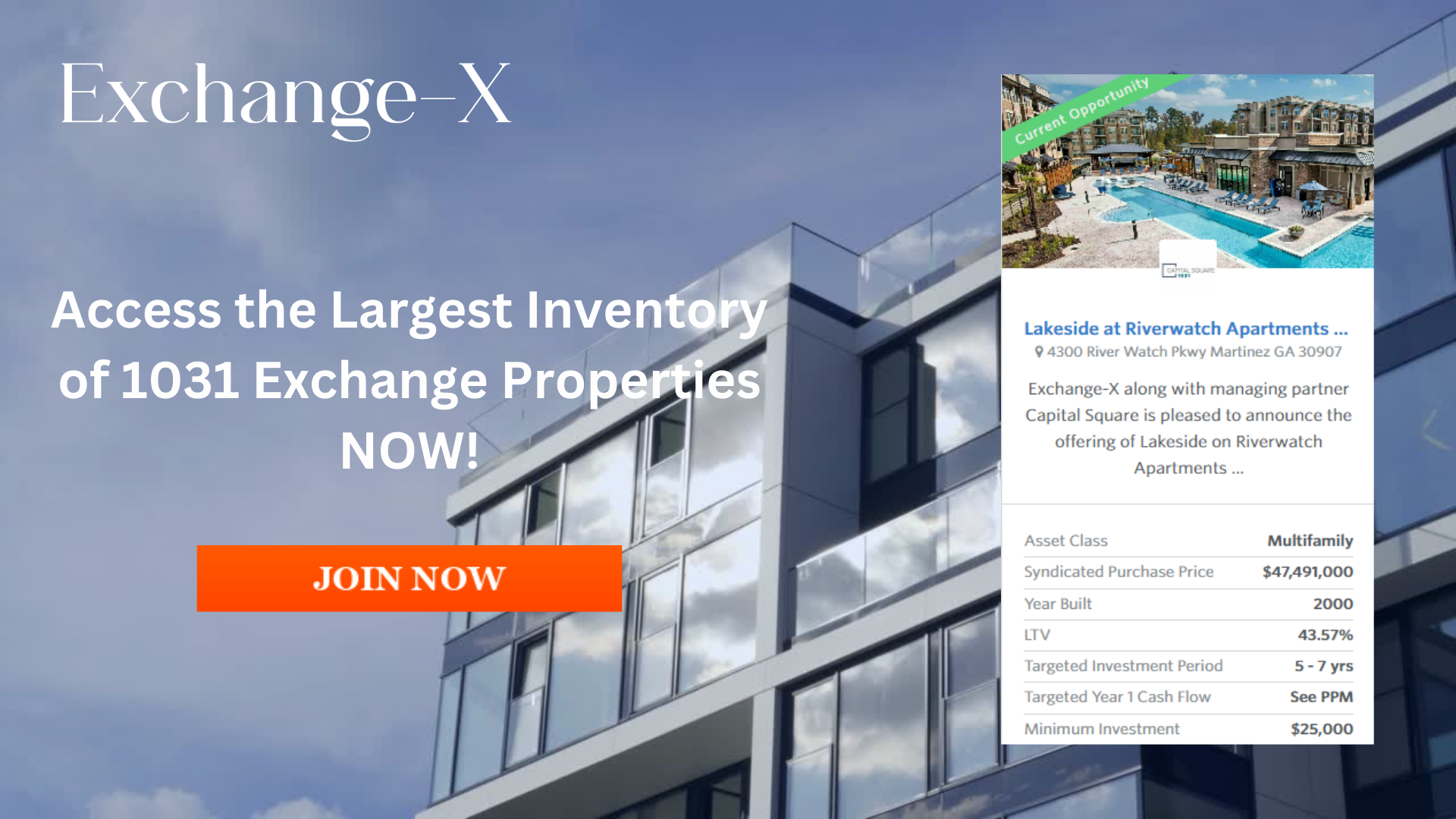

A: Exchange-X makes identifying like-kind property easy. Simply sign up and browse dozens of active offerings on our state-of-the-art platform.

For more information, visit the FAQs section our of site.

Conclusion

Unlocking tax savings is a primary goal for real estate investors, and a 1031 exchange provides a powerful tool to achieve that objective. By deferring capital gains taxes, increasing investable cash, diversifying your portfolio, and potentially accumulating wealth, a 1031 exchange may impact your real estate investments. However, working with qualified professionals who specialize in 1031 exchanges is crucial to navigate the complex rules and ensure a successful transaction.

If you are considering a 1031 exchange or have additional questions about the process, don’t go it alone. Our experts at Exchange-X have helped countless investors navigate the 1031 exchange process successfully, and we would love to assist you as well.

If you are ready to start a 1031 exchange, or have additional questions, schedule a consultation with one of our experts at Exchange-X.

To learn more about how 1031 exchanges and Delaware Statutory Trusts (DST) can complement your portfolio, visit our Resource Center to learn more.

Always consult with your tax advisor or attorney before embarking on a 1031 exchange to understand how it aligns with your financial situation and investment goals.

Join Exchange-X! Click the link above to create an account now and be the first to know about upcoming opportunities.

Download your free copy of “The Power of 1031 Exchanges and Delaware Statutory Trusts (DSTs)” to learn more about how Delaware Statutory Trusts (DST) can complement your portfolio.

Full Disclaimer Copyright 2023 Exchange-X, LLC. All rights reserved.

The contents of this communication: (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, (ii) offers can be made only by the confidential Private Placement Memorandum (the “PPM”) which is available upon request, (iii) do not and cannot replace the PPM and is qualified in its entirety by the PPM, and (iv) may not be relied upon in making an investment decision related to any investment offering by the respective issuer, or any affiliate, or partner thereof (“Issuer”). All potential investors must read the PPM and no person may invest without acknowledging receipt and complete review of the PPM. With respect to the “targeted” goals and performance levels outlined herein, these do not constitute a promise of performance, nor is there any assurance that the investment objectives of any program will be attained. These “targeted” factors are based upon reasonable assumptions more fully outlined in the Offering Documents/ PPM. Consult the PPM for investment conditions, risk factors, minimum requirements, fees and expenses and other pertinent information with respect to any investment. These investment opportunities have not been registered under the Securities Act of 1933 and are being offered pursuant to an exemption therefrom and from applicable state securities laws. Past performance are no guarantee of future results. All information is subject to change. You should always consult a tax professional prior to investing. Investment offerings and investment decisions may only be made on the basis of a confidential private placement memorandum issued by Issuer, or one of its partner/issuers. Issuer does not warrant the accuracy or completeness of the information contained herein. Thank you for your cooperation.

Securities offered through Emerson Equity, LLC Member: FINRA, SIPC (CRD#: 130032/SEC#: 801-71293,8-66296). Only available in states where Emerson Equity, LLC is registered. Emerson Equity, LLC is not affiliated with any other entities identified in this communication.

For more information, read our Disclosures & Disclaimers and Terms of Use.

1031 Risk Disclosure:

- There is no guarantee that any strategy will be successful or achieve investment objectives;

- Potential for property value loss – All real estate investments have the potential to lose value during the life of the investments;

- Change of tax status – The income stream and depreciation schedule for any investment property may affect the property owner’s income bracket and/or tax status. An unfavorable tax ruling may cancel deferral of capital gains and result in immediate tax liabilities;

- Potential for foreclosure – All financed real estate investments have potential for foreclosure;

- Illiquidity – Because 1031 exchanges are commonly offered through private placement offerings and are illiquid securities. There is no secondary market for these investments;

- Reduction or Elimination of Monthly Cash Flow Distributions – Like any investment in real estate, if a property unexpectedly loses tenants or sustains substantial damage, there is potential for suspension of cash flow distributions;

- Impact of fees/expenses – Costs associated with the transaction may impact investors’ returns and may outweigh the tax benefits.