If you own investment real estate and are unfamiliar with the IRC 1031 exchange, it is highly recommended that you educate yourself about this potentially valuable opportunity. The 1031 exchange is widely regarded as one of the most advantageous benefits for owners of investment property in the United States. At Exchange-X, we frequently get questions about the concept of a 1031 exchange and the motivations behind undertaking one.

In this article we will discuss important topics on why an investor should consider a 1031 exchange, including:

- What is a 1031 Exchange?

- Reasons to Consider a 1031 Exchange

- A Simple Solution for a 1031 Exchange

What is a 1031 Exchange?

A 1031 exchange, also known as a like-kind exchange or a tax-deferred exchange, is a provision in the United States Internal Revenue Code that allows real estate owners to defer paying capital gains taxes on the sale of real estate by exchanging into another “like-kind” investment property. The primary reason for engaging in a 1031 exchange is to defer capital gains taxes, potentially saving the taxpayer a significant amount of money.

For additional details, read What is a 1031 Exchange?

Reasons to Consider a 1031 Exchange

Tax Deferral

The most significant advantage of a 1031 exchange is the ability to defer capital gains taxes on the sale of an investment or business property. By reinvesting the proceeds from the sale into a like-kind property, the taxpayer can defer paying taxes until a future sale occurs without incurring any immediate tax liability.

Trade Up

1031 exchange rules state that in order to successfully defer all capital gain taxes, the exchanger must purchase a replacement property that is “equal or greater” value than the relinquished property. Doing a 1031 exchange also allows you to “trade up” to a higher-value property if you choose to do so, growing the value of your portfolio while still deferring any capital gains taxes.

Diversification

A 1031 exchange provides an opportunity to diversify an investment portfolio by exchanging one type of property for another. For example, an investor can exchange a residential rental property for a commercial property, thereby spreading their investment across different asset classes.

Read Diversifying a 1031 Exchange with Delaware Statutory Trusts (DST) to learn more.

Consolidation

A 1031 exchange allows investors to consolidate multiple properties into a single property. For example, an investor with several smaller properties can exchange them for a larger, more valuable property, which may provide better economies of scale, management efficiencies, or increased rental income potential.

Reposition

Location, Location, Location! Transitioning from an inferior property to a superior location in a rapidly growing market can prove to be a more strategic move.

Relieve Landlord Responsibility

Exchanging from a management intensive asset such as Multifamily, Hotel, or Office into a more passive investment, can save landlords time and energy.

Wealth Accumulation

By continually engaging in 1031 exchanges, investors can continuously defer taxes and potentially accumulate more wealth. They can sell properties that have appreciated in value, acquire new ones, and repeat the process. This strategy can enable the compounding of investment gains over time.

Estate Planning

A 1031 exchange can be a useful tool in estate planning. By utilizing 1031 exchanges during their lifetime, property owners can defer capital gains taxes and potentially pass on properties to heirs with a stepped-up basis, potentially reducing the tax burden on the beneficiaries.

A Simple Solution for a 1031 Exchange

If you’re a real estate owner seeking a simplified approach to a 1031 exchange while still enjoying the numerous benefits of real estate, consider a Delaware Statutory Trust (DST).

A Delaware Statutory Trust (DST) is an investment trust that holds real estate assets for the purpose of investing. The trust is formed by a reputable real estate sponsor and is comprised of institutional grade real estate assets. DST properties are typically pre-financed and pre-closed, making the 1031 exchange timelines much simpler to navigate.

Investing in a DST property not only allows for the deferral of capital gain taxes through a 1031 exchange but also provides flexibility when it comes to diversification, consolidation, repositioning, and reducing landlord responsibilities through in-house management. DSTs can also serve as excellent tools for long-term wealth preservation potential and can be utilized for estate planning objectives.

Read What is a Delaware Statutory Trust (DST)? to learn more.

Conclusion

There are many reasons why real estate owners consider a 1031 exchange. The primary benefit of deferring capital gains tax is already substantial. Moreover, a Delaware Statutory Trust (DST) presents a viable alternative for executing a 1031 exchange. DST properties not only qualify for 1031 exchanges but also serve as a convenient option for diversifying and repositioning a real estate portfolio. In situations with strict 45 and 180-day timelines, the Delaware Statutory Trust (DST) proves to be an excellent backup solution worth considering.

It is important to note that while a 1031 exchange can offer significant tax benefits, it requires adherence to strict rules and regulations set forth by the IRS. It is recommended to consult with a qualified tax advisor or intermediary to ensure compliance and maximize the advantages of a 1031 exchange. It is always recommended to consult with a licensed tax professional about the potential advantages a 1031 exchange can offer your particular exchange.

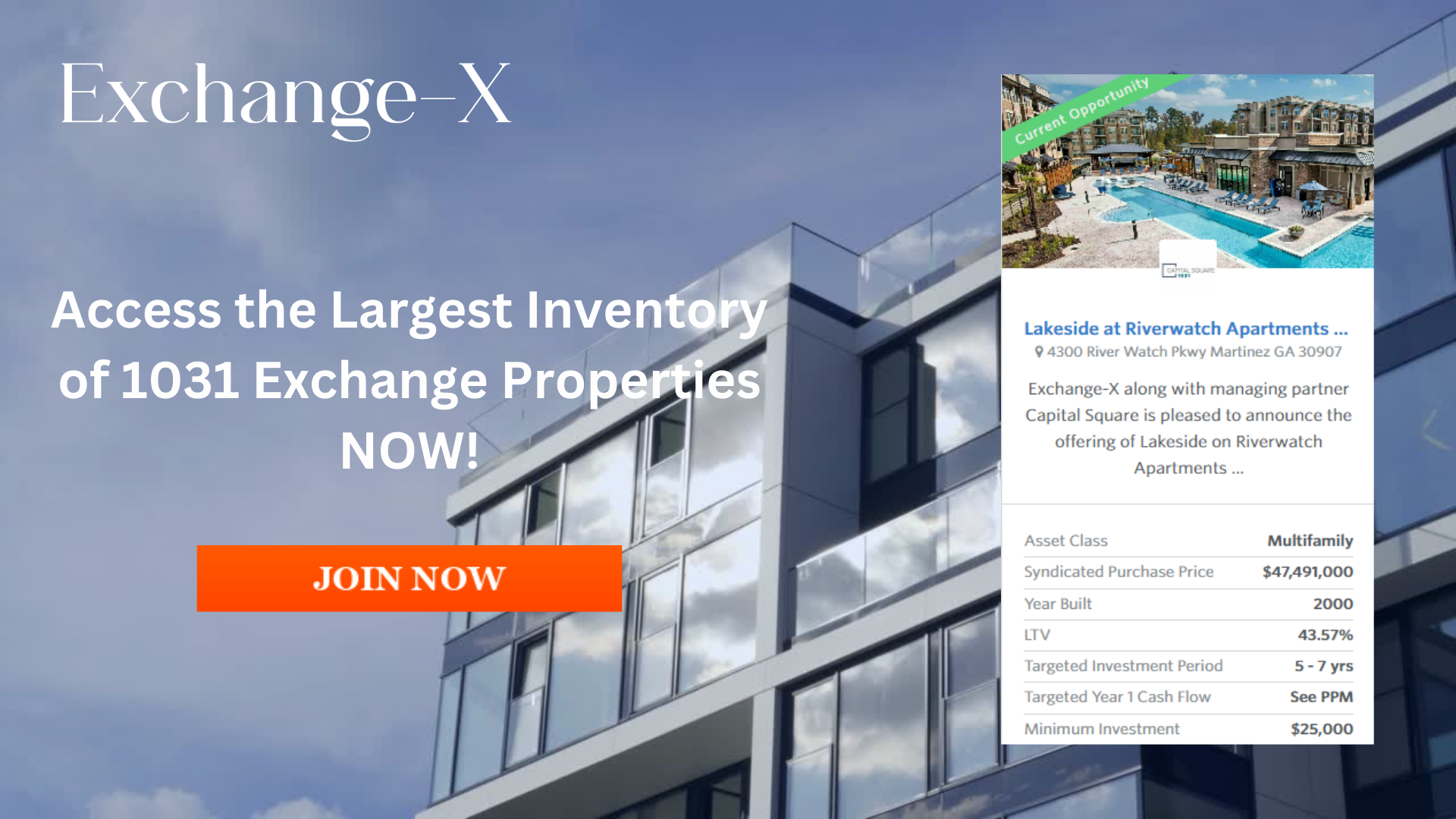

Our team at Exchange-X has years of experience with DSTs and are here to help you navigate the process. If you are in a 1031 exchange or want to learn more about how DSTs can complement your portfolio, schedule a call with a financial professional or call (888) 775-1031 today.

Join Exchange-X! Click the link above to create an account now and be the first to know about upcoming opportunities.

Download your free copy of “The Power of 1031 Exchanges and Delaware Statutory Trusts (DSTs)” to learn more about how Delaware Statutory Trusts (DST) can complement your portfolio.