If you own commercial real estate and have successfully exchanged like-kind property, great job! A 1031 exchange is no simple task as there are many moving parts involved. Even more challenging, is the ability to successfully diversify into multiple properties within an exchange. Strict 45-day property identification and 180-day closing timelines can make diversifying a traditional exchange extremely difficult.

A popular solution to this problem is diversifying with a Delaware Statutory Trust (DST) replacement property. A DST property offers the flexibility and simplicity to easily identify, inspect and close on institutional grade properties that are pre-financed and pre-closed within 1031 timelines. In this article we will discuss topics including:

- Why Diversify a 1031 Exchange?

- 1031 Diversification Strategies

- A Solution to Diversify a 1031 Exchange

Why Diversify a 1031 Exchange?

Many investors are familiar with the Modern Portfolio Theory which is best known for attempting to optimize returns and mitigate losses. While the success of this strategy is questionable, one aspect that can be taken away is diversification.

Real estate, like many investments, can come with inherent risks including supply/demand balance, local market conditions, cost of capital (interest), taxes, natural disasters, etc. The best proven strategy for potentially optimizing returns and mitigating loss is diversification. Diversification allows an investor to target the same potential expected return over several assets within a portfolio and strive to reduce risk by not over concentrating.

There are numerous strategies a real estate investor can use to diversify their real estate holdings including location, asset class, tenants, property management, and investment allocation.

Let’s look at a few of these strategies in more detail.

1031 Diversification Strategies

Location

The adage goes… “Location, Location, Location”. Maybe we should take this literally and figuratively. With many primary, secondary, and tertiary cities across the country showing substantial economic growth, there is no shortage of opportunities. Diversification over various geographic locations can potentially reduce risk exposure to local economies as well as areas prone to natural disasters.

For example, large, populated cities such as New York city were heavily impacted during the Covid-19 pandemic where smaller cities like Tampa Florida witnessed positive year over year population growth.

Furthermore, some investors prefer diversifying into income tax free states such as Florida, Texas, South Dakota, Nevada, Alaska, Washington, Wyoming New Hampshire, and Tennessee to lessen tax liabilities.

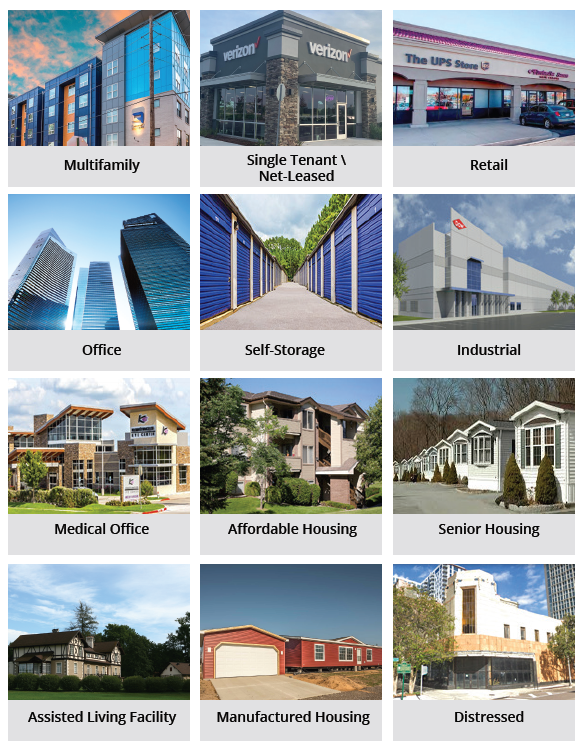

Sector

Sector diversification is another essential strategy to reduce overall risk associated with industry exposure. With about a dozen sectors to choose from, an investor may choose to diversify into more recession resilient assets such as multifamily and self-storage in weak economies. In times of strong economic growth, an investor may choose to own more historically aggressive asset classes such as hospitality, office or senior care.

A popular diversification strategy is owning several asset classes to attempt to capture a blended annual return and be potentially further insulated against economic impact. For example, one may invest in a multifamily complex with a 5% annual cash flow, a retail portfolio with a 6% annual cash flow and a self-storage facility with a 7% annual cash flow, averaging a 6% blended total annual return.

**The above example is for educational purposes only and do not reflect actual DST properties

Tenants

Each asset class has a unique tenant base, consisting of different credit quality, lease term, maintenance responsibility, etc. Diversifying among tenants is perhaps one of the leading strategies an astute real estate investor can do.

For example, a property owner owns a short-term rental which is management intensive but returns strong double digit annual returns in times of economic strength. This investor may consider adding a retail property with a strong investment grade national tenant on a long-term net lease with a corporate guarantee such as Starbucks, Walgreens or McDonalds. The long-term credit lease may help create a stream of steady potential cash flow for the life of the lease, ultimately offsetting most volatility associated with the short-term rental property.

Property & Asset Management

Often overlooked, property and asset management are key in maintaining a successful real estate investment. Depending on the level of management, a successful property manager can make or break a property, eventually leading to a decline in value. One way to safeguard against this issue is to hire a best-in-class property management company to ensure your investment is optimized. This includes aggressive leasing programs, onsite management, property maintenance, expense budgeting, organizing contractors, implementing value-add strategies, and more.

Investment Allocation

Selling a large, single investment property and reallocating the funds among multiple properties can potentially have a major impact on risk and returns. This allows the investor to strive to safeguard their portfolio in a prudent way, attempting to keep risk and unforeseen disasters under control.

An example of this would be to sell a multifamily property for $5 million and split the investment into five essential net-lease (NNN) properties in multiple markets throughout a various tenant base.

A Solution to Diversify a 1031 Exchange

For a simple way to diversify a 1031 exchange, consider a Delaware Statutory Trust (DST). Beneficial interests in DSTs are considered “like-kind” property for purposes of 1031 exchanges. A DST can offer investors the flexibility to easily diversify an exchange throughout various geographic locations, sectors, tenant base, property managers, and capital allocation.

For example, office properties in a major metropolitan city, self-storage properties in multiple locations, or a regional-based portfolio of properties.

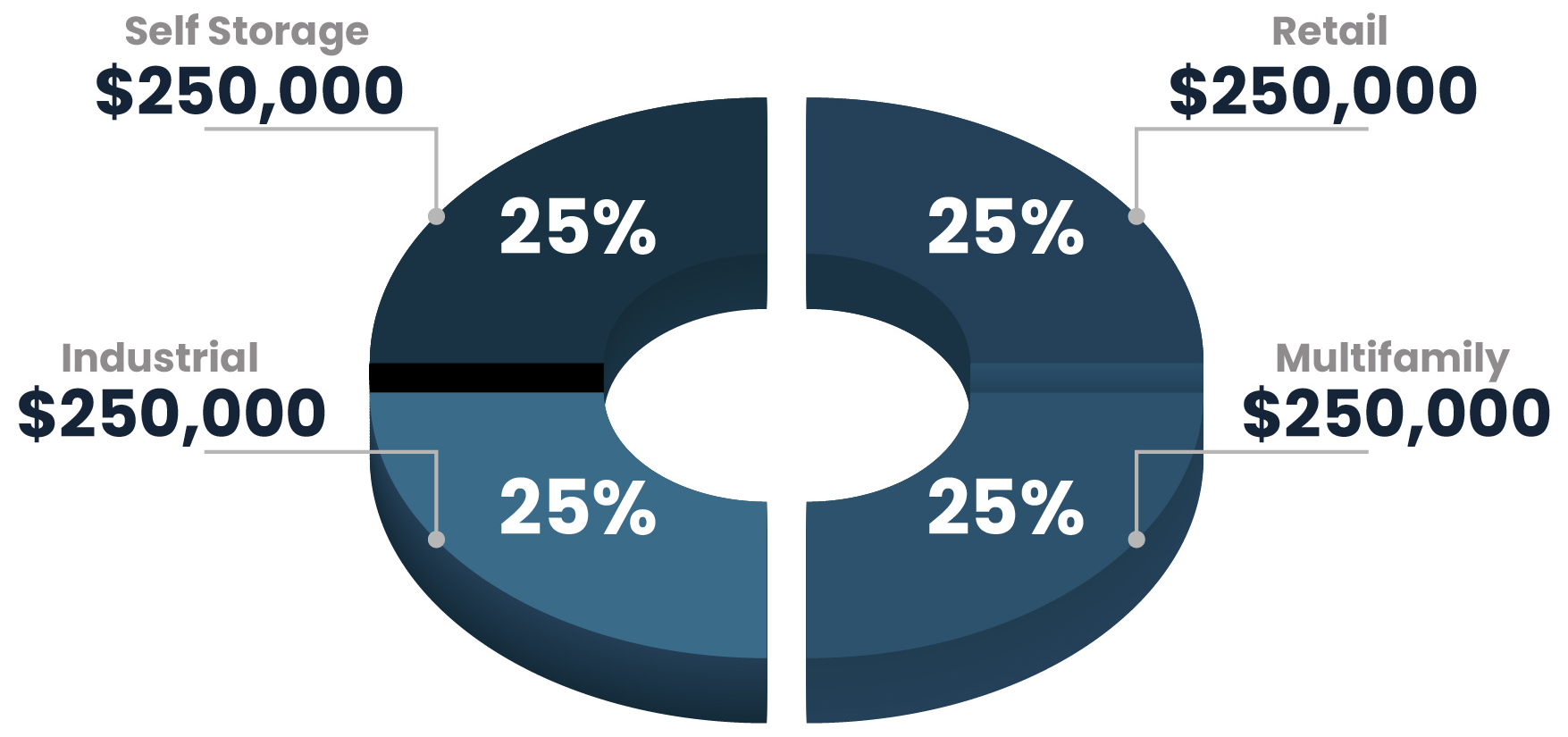

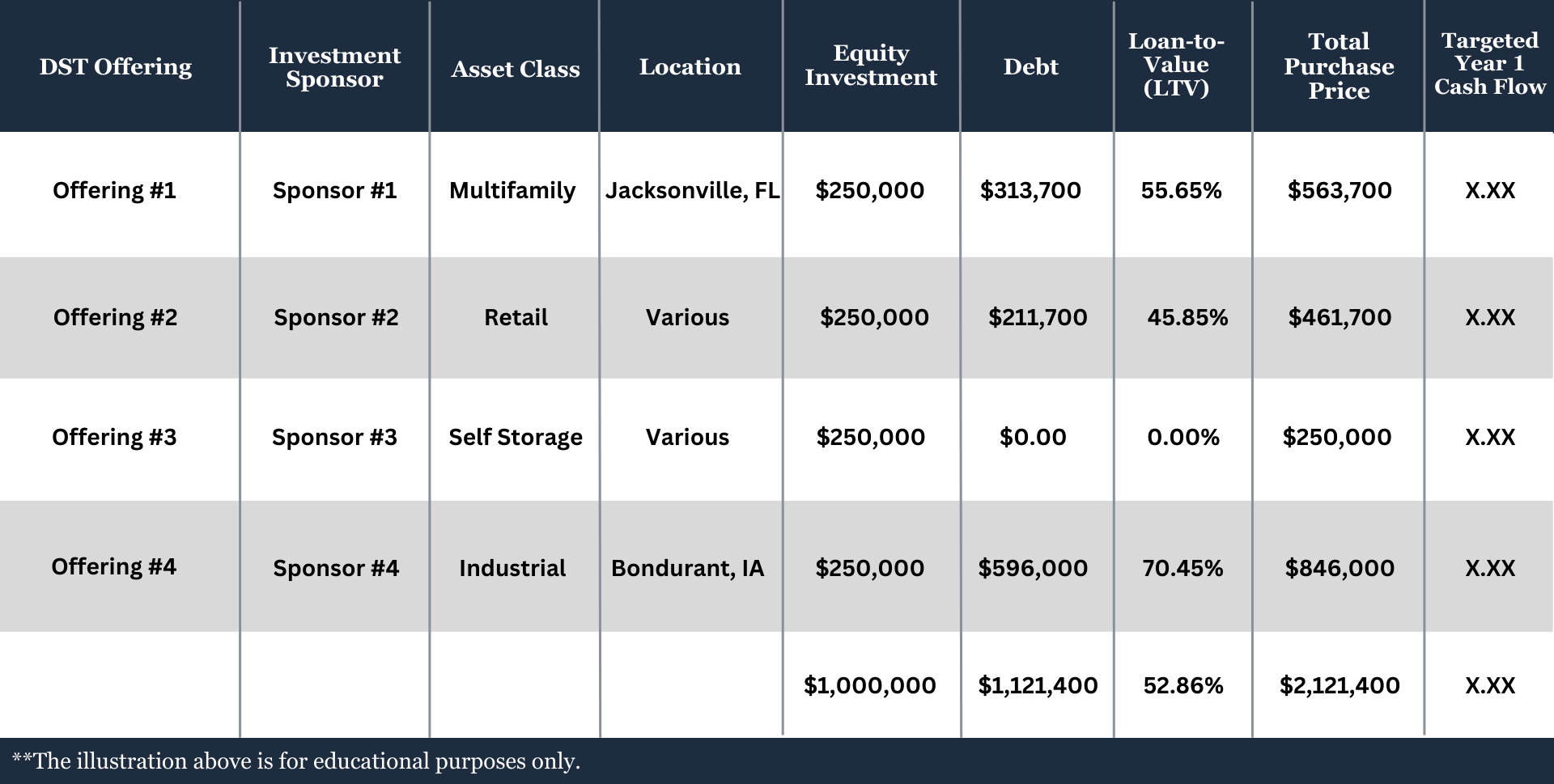

Let us take a look at a hypothetical $1,000,000 cash investment below.

**The illustration above represents a $1,000,000 cash investment diversified among various asset types.

**The illustration above is for educational purposes only.

In the above graph, the investor can take $250,000 in equity and diversify among four different sectors potentially offering the investor added insulation against market and sector volatility.

**The illustration above represents a $1,000,000 cash investment diversified among various asset types.

**The illustration above is for educational purposes only.

In addition, a DSTs minimum investment threshold allows a purchaser to own several institutional grade assets with minimums as low as $25,000 cash and $100,000 for 1031 exchanges. In addition, a DST owner potentially benefits from best-in-class professional expertise including acquisition, financing, property management and asset management.

For more information on DSTs, refer to What is a Delaware Statutory Trust (DST)? and 10 Potential Advantages of Owning a Delaware Statutory Trust (DST)

Conclusion

Diversifying a portfolio within 1031 timelines can bode to be extremely challenging. The DST serves as the superior option for exchangers looking to sell one property and exchange into multiple properties among various locations, sectors, tenants, management, and investment allocation.

If you are ready to start a 1031 exchange or have any additional questions about how it might work for your specific situation, schedule a consultation with one of our experts or call (888) 775-1031.

To learn more about how 1031 exchanges and Delaware Statutory Trusts (DST) can complement your portfolio, visit our Resource Center.

Join Exchange-X! Click the link above to create an account now and be the first to know about upcoming opportunities.

Download your free copy of “The Power of 1031 Exchanges and Delaware Statutory Trusts (DSTs)” to learn more about how Delaware Statutory Trusts (DST) can complement your portfolio.