Real estate ownership can come with many complex aspects including property management, construction management, maintenance, leasing, etc. Another very important aspect we have touched upon in detail is what a 1031 Exchange is and the potential benefits one can offer. One might wonder how the Exchange process works and how to accomplishing a successful exchange. Arguably, the most crucial component of a 1031 exchange is the 1031 Exchange Accommodator or Qualified Intermediary (QI).

In this article we will touch on many important topics including:

- What is a Qualified Intermediary (QI)?

- What role does the Qualified Intermediary (QI) play in an exchange?

- What Steps are involved in a 1031 Exchange?

- Costs and Pricing Structures for QIs

- Suggested Questions for Your Qualified Intermediary (QI)

What is a Qualified Intermediary (QI)?

A Qualified Intermediary (QI), also known as the exchange accommodator or exchange facilitator is an independent entity that is not the investor, an agent of the investor, or a related party to the investor that enters into a written agreement with the investor to complete exchange transactions on behalf of the investors for the purpose of adhering to 1031 exchange requirements. In other words, when an investor decides to sell a property and utilize a 1031 exchange, an intermediary must be hired to take physical control of the sale proceeds and hold them in a 1031 escrow account.

This process ensures the investor does not take physical control of the proceeds and the exchanger can stay in compliance with the IRC tax laws that govern section 1031 of the IRS tax code. To defer paying capital gain and depreciation recapture taxes upon the sale of real property, the taxpayer must avoid taking possession of both actual receipt and constructive receipt of the final sales proceeds. If an investor were to take receipt of the proceeds from the sale of a property, the exchange would then be null and void and subject to full taxation.

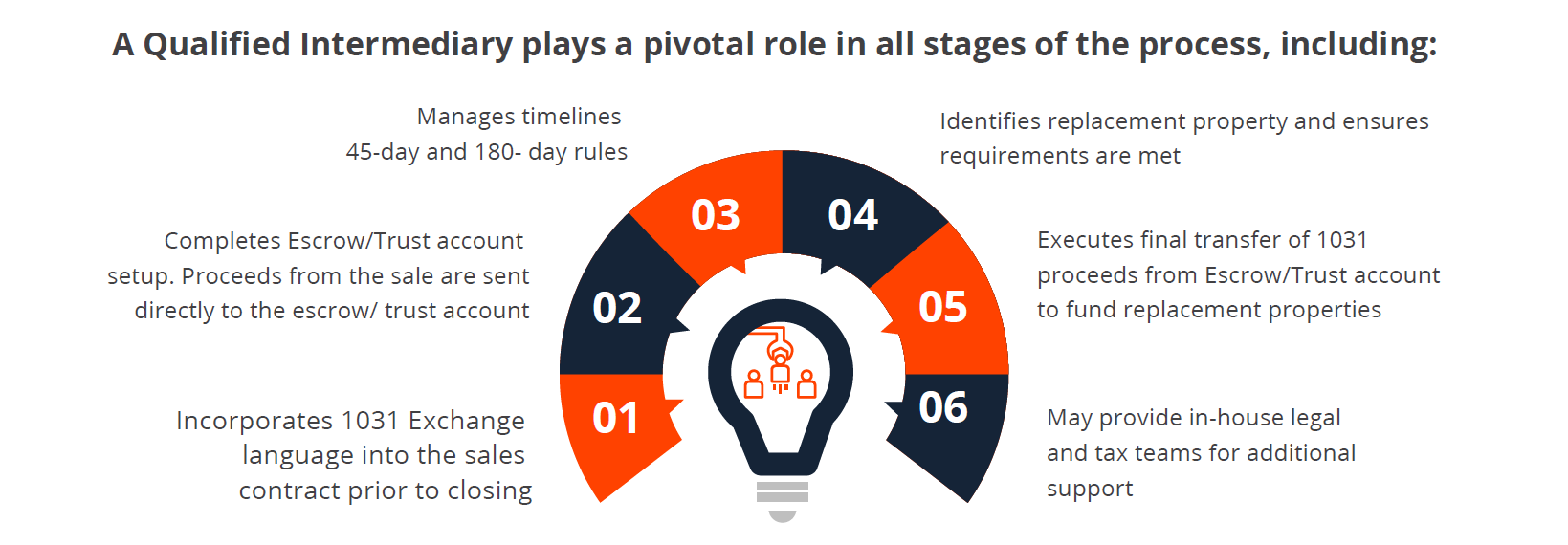

What role does the Qualified Intermediary (QI) play in an exchange?

Think of the Qualified Intermediary (QI) as the glue that holds the buyer and seller together in a 1031 exchange. Aside from being the heart of the exchange itself, the main function of the QI is to restrict the investor’s access to the sale proceeds upon the sale of the relinquished property and comply with the “safe harbor” rules set out in reg. 1.1031(k)-1(g)(4). This is done by holding the final sales proceeds of the relinquished property in a qualified escrow account specifically dedicated to holding exchange funds.

For an exchange to qualify for “safe harbor”, there must be a written agreement between the taxpayer and intermediary limiting the taxpayer’s rights to receive, pledge, borrow or otherwise obtain the funds or property held by the intermediary. The qualified intermediary does not actually have to be in the chain of title.

In addition, there are no licensing requirements for Intermediaries. Accountants, attorneys, and realtors who have served taxpayers in their professional capacities within the prior two years are disqualified from serving as a Qualified Intermediary (QI) for a taxpayer in an exchange. This is mainly due to a potential conflict of interest upon attempting a 1031 exchange.

Services offered by a QI include:

- Holding exchange proceeds in escrow on behalf of the taxpayer;

- Coordinating with the taxpayer’s attorney and/or tax advisor and providing exchange transaction documents;

- Preparing exchange documents which including exchange agreements, assignment agreements, notice of assignment, account forms, security of funds instruments (when applicable) and instructions for the closing agents;

- Providing guidance, information and critical timelines throughout the entire 1031 exchange process;

- Facilitating the sale of the relinquished property for the buyer and the purchase of the replacement property from the seller;

- Authorizing the release of 1031 funds to satisfy the close.

What Steps are involved in a 1031 Exchange?

Although the process of completing an exchange is relatively simple, the rules are complicated and filled with potential pitfalls. In a previous article titled, How does a 1031 Exchange Work? we go into further detail on how to commence a 1031 exchange and the timelines involved. For this article, let’s focus on the timelines associated with a Qualified Intermediary (QI).

Step 1: Consult with a Qualified Intermediary (QI) before you decide to sell your property.

Step 2: Prior to closing, (the seller) implement 1031 exchange language into the contract to acknowledge the future use of an exchange.

Step 3: 45-Day Identification Period: Once the property is sold, the exchanger has 45 calendar days from the day of closing to identify what replacement property(s) will be acquired.

Step 4: 180-Day Closing Period: Once the properties are identified, the exchanger has an additional 135 calendar days (180 days from close) to close on the properties identified in the 45-day ID period.

Step 5: At closing, the QI will release the funds to satisfy the purchase.

Read The 1031 Exchange Process Explained for additional details.

Costs and Pricing Structures for QIs

Qualified Intermediaries (QIs) employ various fee structures, and understanding these differences is important when choosing the right one for your needs. Some QIs opt for a flat-rate fee, while others calculate charges based on the interest earned on funds during the holding period. Additionally, how these QIs distribute the earned interest can vary.

It’s essential to recognize that the level of experience and expertise a QI possesses directly impacts the cost of their services. While cost is a significant factor in your decision-making process, it’s equally important to balance it with the level of service and coverage you require. Generally, QIs charge in the range of $800 to $1,500 for traditional simultaneous exchanges and over $1,500 for more complex exchanges such as delayed, reverse or improvement.

Thankfully, prospective clients have the option to request quotes from potential QIs, providing valuable insights to aid in their decision-making process. In addition to the initial pricing, it’s advisable to inquire about any additional fees associated with their services to ensure you are fully prepared for the financial aspects of your exchange.

Contact us today for a complete list of Qualified Intermediaries (QIs) near you.

Suggested Questions for Your Qualified Intermediary (QI)?

Although the exchange process can complex, some basic due diligence questions you will want to ask your QI are:

- How long have you been a Qualified Intermediary (QI)?

- How many 1031 Exchanges have you administered (individual 1031 Exchange officer and 1031 Exchange Qualified Intermediary)?

- Do you hold clients’ 1031 Exchange funds in a segregated Qualified Trust Account or a Qualified Escrow Account?

- Do you maintain errors and omissions (E&O) insurance coverage to insure against any 1031 Exchange Qualified Intermediary liability?

- What is the policy limit of your errors and omissions insurance coverage?

- Do you maintain fidelity bond insurance coverage to insure against employee theft, embezzlement, or misappropriation of the 1031 Exchange funds?

- What is the policy limit of your fidelity bond coverage?

- Is your fidelity bond coverage “per occurrence” or merely “in aggregate”?

- Do you provide me with copies of your insurance binders so I can verify that your insurance coverage is still in full force and effect?

- Do your fidelity bond and errors and omissions (E&O) insurance policies cover just the 1031 Exchange Qualified Intermediary, or do they also cover numerous other related entity operations that might diminish the overall protection to me in the event of loss such as title insurance, escrow, etc.?

- What type of internal processes and internal audit controls have you implemented to protect my 1031 Exchange assets?

- Will an administrators call me prior to the disbursement of my 1031 Exchange funds to ensure that I want the funds disbursed (as opposed to disbursing when escrow calls)?

- Where are my 1031 Exchange funds held or invested?

Conclusion

It is imperative to choose an experienced Qualified Intermediary (QI) carefully since they are ultimately responsible for keeping your exchange Federally compliant with IRS tax laws and guide you through a successful exchange. An experienced QI who is familiar with all 1031 exchange laws could be a great addition to your real estate team and potentially save you millions in tax liabilities.

Remember, there are no federal or state regulation along with no licensing requirements for QIs, so any agent can become a QI as long as they do not fall into one of the few categories that are restricted from acting as a QI, such as accountants, attorneys and realtors who have served the taxpayer in their professional capacities within the prior two years, or any person related to the taxpayer. Furthermore, QIs often hold large sums of capital on behalf of the investors they serve and often do not have a guarantee of security on those funds in case the QI were to become bankrupt.

Each QI operates in a different manner and may make different decisions on how the funds are pooled and invested during the time in which the QI has possession along with different fee structures. Some may charge a flat rate while others may take into consideration the interest earned on the funds during the period the funds are held. Likewise, the interest earned on the funds may be paid in different ways by different QIs.

At Exchange-X, we do not offer tax advice or advice directly relating to taxes but can refer a list of trusted 1031 Qualified Intermediaries.

If you are ready to start a 1031 exchange, or have additional questions, schedule a consultation with one of our experts at Exchange-X.

To learn more about how 1031 exchanges and Delaware Statutory Trusts (DST) can complement your portfolio, visit our Resource Center.

Always consult with your tax advisor or attorney before embarking on a 1031 exchange to understand how it aligns with your financial situation and investment goals.

Join Exchange-X! Click the link above to create an account now and be the first to know about upcoming opportunities.

Download your free copy of “The Power of 1031 Exchanges and Delaware Statutory Trusts (DSTs)” to learn more about how Delaware Statutory Trusts (DST) can complement your portfolio.