In today’s ever-changing financial landscape, investors constantly seek opportunities to provide them with the potential for steady cash flow and financial security. One such avenue that has gained significant popularity is investing to seek cash flow using Delaware Statutory Trusts (DSTs). This article explores the power of DSTs for cash investors and sheds light on the potential benefits and considerations with this investment strategy.

In this article we’ll discuss how cash investors can utilize a DST property for potential cash flow by:

- Understanding Cash Flow Investing

- The Basics of DSTs

- Potential Benefits of Investing in DSTs

- How to Get Started with DST Investments

- Critical Considerations for Cash Investors

- Common FAQs about DST Investments

Understanding Cash Flow Investing

Before delving into the specifics of DSTs, it is essential to understand the concept of cash flow investing. Cash flow investing revolves around striving to generate a consistent income stream from investments, such as real estate, that can provide regular payouts. The focus is on attempting to generate passive income that can supplement or replace traditional employment income, thereby achieving financial freedom.

The Basics of DSTs

Delaware Statutory Trusts (DSTs) are a popular investment vehicle for individuals seeking cash flow. A DST is a legal entity that allows investors to own fractional interests in large-scale, professionally managed real estate properties. These properties include apartment complexes, shopping centers, office buildings, and industrial parks. By pooling their resources, investors can benefit from the property’s potential income and appreciation.

Potential Benefits of Investing in DSTs

Passive Income:

DSTs allow investors the potential to earn passive income as professional managers handle the day-to-day operations of the properties. Investors can seek a consistent cash flow without the need for active involvement.

Diversification:

By investing in DSTs, cash investors can access a diversified portfolio of high-quality real estate properties. This diversification helps mitigate risk and reduces dependency on a single property or market.

Tax Advantages:

DSTs offer potential tax benefits, such as depreciation deductions and the ability to defer capital gains taxes through a 1031 exchange. These tax advantages can potentially enhance overall returns and improve the cash flow generated by the investments.

Professional Management:

DSTs are managed by experienced professionals with extensive real estate market knowledge. This expertise improves the potential for effective property management, seeking to maximize the potential for cash flow and long-term appreciation.

To learn more, read 10 Potential Advantages of Owning a Delaware Statutory Trust (DST) .

How to Get Started with DST Investments

To embark on a DST investment journey, cash investors can follow these steps:

Research and Education:

Begin by researching DSTs and their investment opportunities. Understand this investment strategy’s key concepts, potential benefits, and risks. Leverage out resource center to learn more.

Define Investment Goals:

Determine your investment objectives, risk tolerance, and desired cash flow requirements. This clarity will help you select DSTs that have stated objectives that align with your financial goals.

Seek Professional Guidance:

Consult with a qualified financial professional professional specializing in DST investments. These specialists understand DST properties and can provide personalized advice based on your unique circumstances and help you identify suitable opportunities.

Due Diligence:

Conduct thorough due diligence on any DST you are considering. Easily review offering documents, Private Placement Memorandums (PPM), financial statements, and property details to ensure they align with your investment objectives through our state-of-the-art DST marketplace.

Investment and Documentation:

Once you have selected a DST, complete the necessary paperwork and submit your purchase. Review and understand the terms and conditions before finalizing your purchase.

Critical Considerations for Cash Investors

Risk Management:

While DSTs offer potential benefits, assessing and managing risks is crucial. Understand the risks of real estate investments, such as market fluctuations, property vacancies, and economic downturns.

Cash Flow Analysis:

Analyze the targeted cash flow of the DST investment carefully. Consider factors like rental income, operating expenses, debt service, and potential fluctuations in rental rates.

Investment Horizon:

Determine your investment horizon and evaluate whether the DST aligns with your desired time frame. Some DST investments have a fixed term, while others may offer exit options at specific intervals.

Exit Strategies:

Familiarize yourself with the available exit strategies for your DST investment. Understand the limitations, potential penalties, and restrictions on selling your fractional interests.

Common FAQs about DST Investments

- Can I invest in DSTs with a small amount of cash?

- Yes, DSTs allow investors to participate with smaller amounts than a direct property purchase. Minimum investment requirements may vary depending on the specific DST.

- Are DSTs only for accredited investors?

- While most DST offerings are available exclusively to accredited investors, there are also opportunities for non-accredited investors to participate. Consult with your financial professional to explore suitable options.

- Can I use DST investments for retirement or estate planning?

- Yes, DSTs can be a part of a well-diversified retirement portfolio. They offer potential cash flow and tax advantages that align with retirement and estate planning objectives.

- How is the cash flow from DST investments distributed?

- DSTs seek to distribute cash flow to investors regularly, typically monthly or quarterly. The distribution amount, if any, is determined based on the performance of the underlying properties.

- What happens if a DST property needs major repairs?

- DSTs set aside reserves for property repairs and maintenance. These reserves help cover unexpected expenses, seeking to ensure that cash flow to investors remains stable.

For more FAQs, visit the FAQ section of our site.

Conclusion

Investing for cash flow potential is a powerful strategy for individuals seeking financial independence and stability. Delaware Statutory Trusts (DSTs) provide cash investors an excellent opportunity to seek to generate passive income and benefit from professionally managed real estate properties. By conducting thorough research, seeking professional guidance, and carefully evaluating the potential benefits and risks, investors can leverage the power of DSTs to attempt to achieve their cash flow goals.

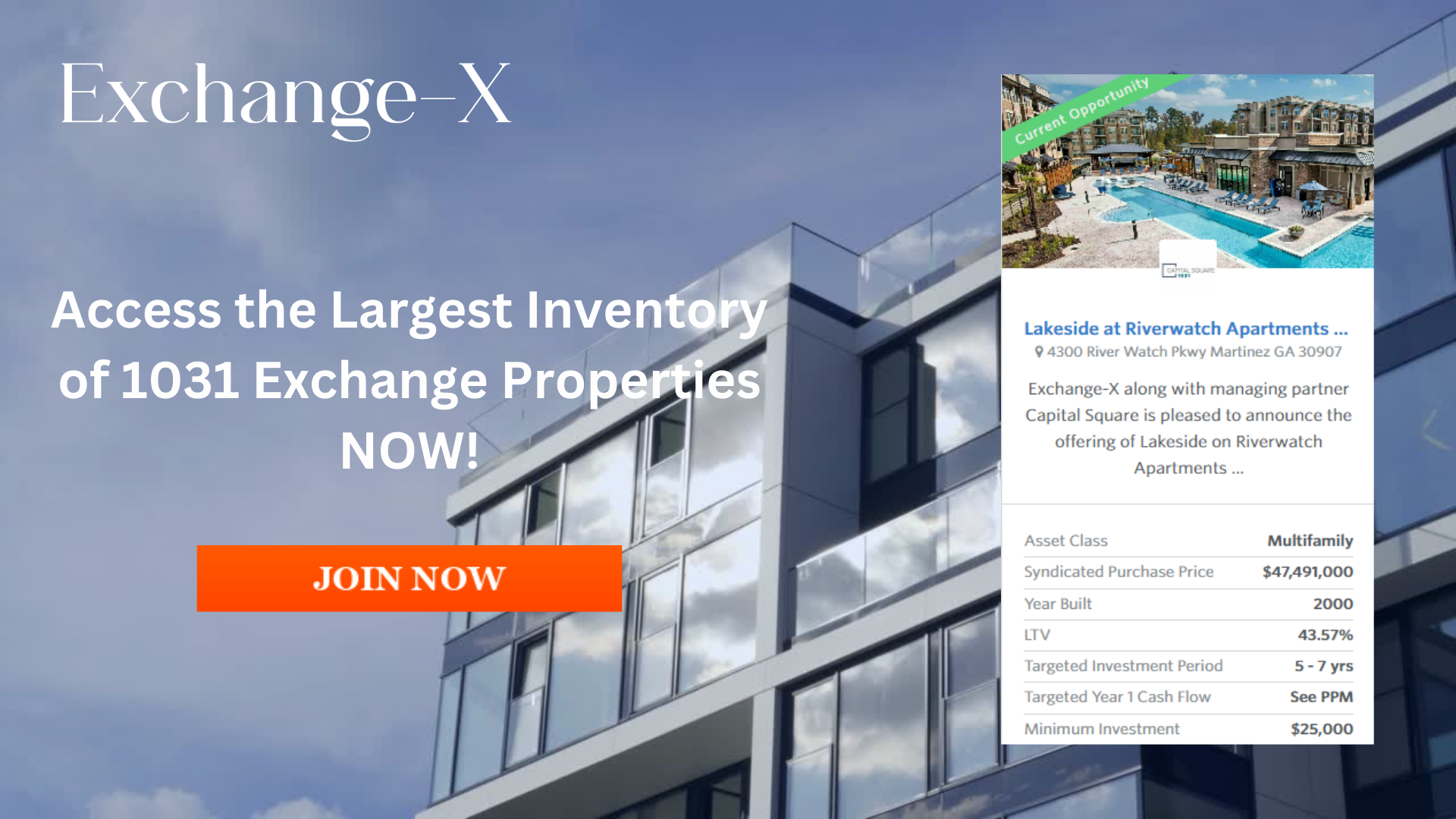

Our team at Exchange-X has years of experience with DSTs and would be glad to help you navigate the process. If you are in a 1031 exchange or want to learn more about how DSTs can complement your portfolio, schedule a call with an advisor or call (888) 775-1031 today.

Join Exchange-X! Click the link above to create an account now and be the first to know about upcoming opportunities.

Download your free copy of “The Power of 1031 Exchanges and Delaware Statutory Trusts (DSTs)” to learn more about how Delaware Statutory Trusts (DST) can complement your portfolio.

Full Disclaimer Copyright 2023 Exchange-X, LLC. All rights reserved.

The contents of this communication: (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, (ii) offers can be made only by the confidential Private Placement Memorandum (the “PPM”) which is available upon request, (iii) do not and cannot replace the PPM and is qualified in its entirety by the PPM, and (iv) may not be relied upon in making an investment decision related to any investment offering by the respective issuer, or any affiliate, or partner thereof (“Issuer”). All potential investors must read the PPM and no person may invest without acknowledging receipt and complete review of the PPM. With respect to the “targeted” goals and performance levels outlined herein, these do not constitute a promise of performance, nor is there any assurance that the investment objectives of any program will be attained. These “targeted” factors are based upon reasonable assumptions more fully outlined in the Offering Documents/ PPM. Consult the PPM for investment conditions, risk factors, minimum requirements, fees and expenses and other pertinent information with respect to any investment. These investment opportunities have not been registered under the Securities Act of 1933 and are being offered pursuant to an exemption therefrom and from applicable state securities laws. Past performance are no guarantee of future results. All information is subject to change. You should always consult a tax professional prior to investing. Investment offerings and investment decisions may only be made on the basis of a confidential private placement memorandum issued by Issuer, or one of its partner/issuers. Issuer does not warrant the accuracy or completeness of the information contained herein. Thank you for your cooperation.

Securities offered through Emerson Equity, LLC Member: FINRA, SIPC (CRD#: 130032/SEC#: 801-71293,8-66296). Only available in states where Emerson Equity, LLC is registered. Emerson Equity, LLC is not affiliated with any other entities identified in this communication.

For more information, read our Disclosures & Disclaimers and Terms of Use.

1031 Risk Disclosure:

- There is no guarantee that any strategy will be successful or achieve investment objectives;

- Potential for property value loss – All real estate investments have the potential to lose value during the life of the investments;

- Change of tax status – The income stream and depreciation schedule for any investment property may affect the property owner’s income bracket and/or tax status. An unfavorable tax ruling may cancel deferral of capital gains and result in immediate tax liabilities;

- Potential for foreclosure – All financed real estate investments have potential for foreclosure;

- Illiquidity – Because 1031 exchanges are commonly offered through private placement offerings and are illiquid securities. There is no secondary market for these investments;

- Reduction or Elimination of Monthly Cash Flow Distributions – Like any investment in real estate, if a property unexpectedly loses tenants or sustains substantial damage, there is potential for suspension of cash flow distributions;

- Impact of fees/expenses – Costs associated with the transaction may impact investors’ returns and may outweigh the tax benefits.