- Difficulty finding suitable replacement propreties?

- Nearing the end of your exchange ID window?

- Difficulty securing financing

- Tired of property management headaches?

- Looking to diversify your real estate portfolio?

Real estate investing today is more competitive than ever. Whether identifying the right investment, competing in an overcrowded marketplace, securing adequate financing, or fulfilling strict 1031 exchange deadlines, Exchange-X has the solution.

In this article we are going to cover topics including:

- Who is Exchange-X

- What We Offer

- Potential Benefits of Partnering

Who is Exchange-X?

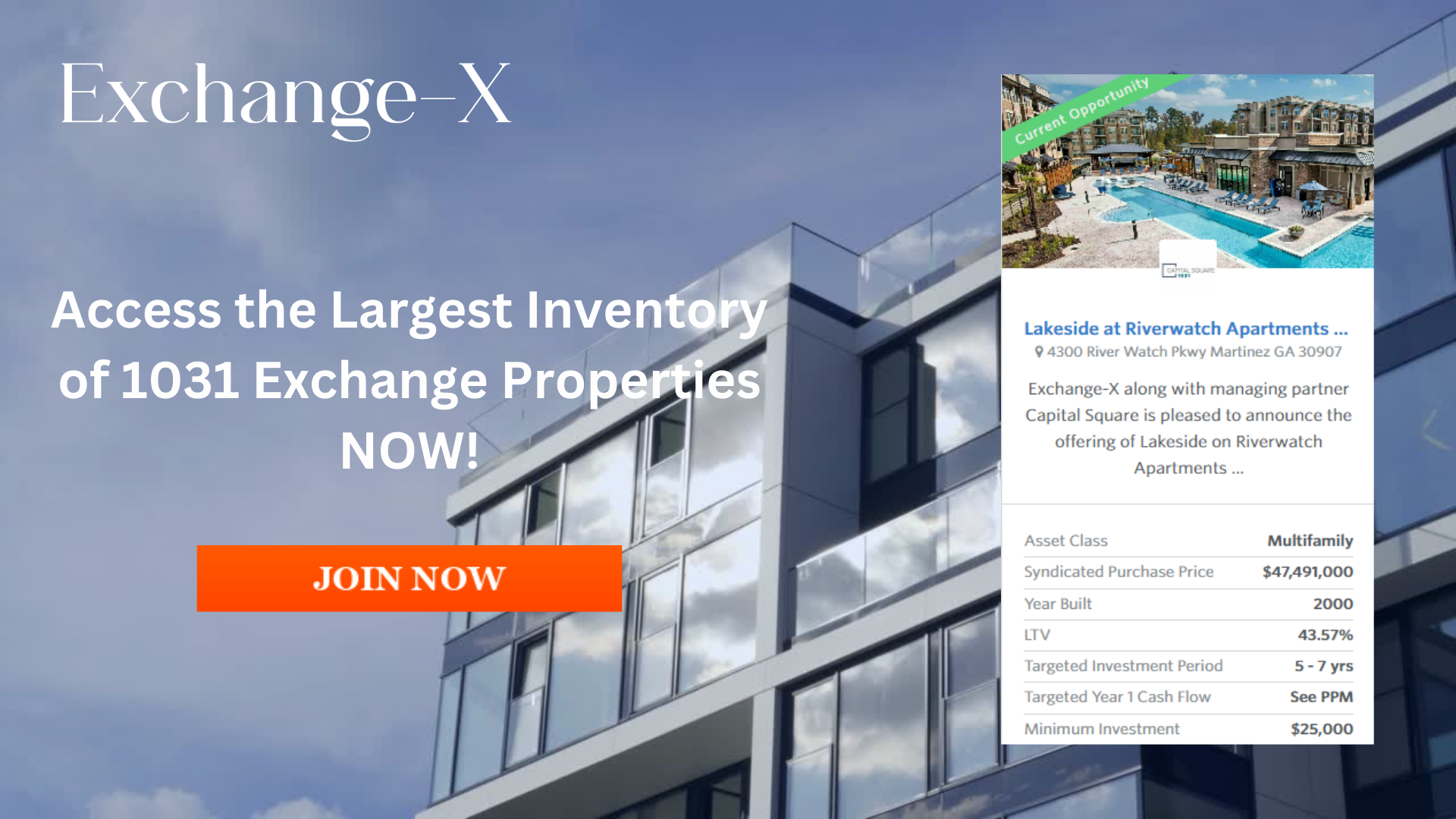

Exchange-X is a leading 1031 Exchange real estate investment platform for Delaware Statutory Trust (DST) properties. The Exchange-X marketplace offers direct access to over 50 leading DST sponsors and dozens of active offerings. Our extensive track record comes with over $1 billion in transactions and 50 years of combined experience.

What We Offer

Exchange-X offers a state-of-the-art DST property platform for 1031 exchangers to easily view, identify and through our relationship with Emerson Equity LLC, purchase institutional-grade replacement properties direct from over 50 leading DST sponsor firms. Our extensive selection of pre-vetted, pre-financed and pre-closed DSTs give 1031 exchangers the confidence they need when entering a 1031 exchange.

Some benefits include:

✅ Extensive 1031 Property Inventory

✅ State-of-the-Art Investment Platform

✅ 70+ Best-in-Class Sponsors

✅ Transparent Due Diligence

✅ News and Industry Insights

✅ Dedicated Licensed Professionals

✅ Educational Articles & Videos

Potential Benefits of Partnering

Marketplace

Through the Exchange-X marketplace, investors now have full access to a robust selection of 1031 exchange turnkey properties. Members can easily download Offering Memorandums, Private Placement Memorandums, Subscription Documents and more.

Diversification

Investors now have the opportunity to fully diversify their portfolio by acquiring beneficial interests of investment grade properties throughout various geographical locations, asset classes, property types and tenant profiles.

Tax Optimization

DST properties offer similar tax benefits traditional real estate offers including depreciation and mortgage interest write offs, as well as the ability to 1031 Exchange and defer capital gain taxes.

Passive Ownership

Real estate by nature is an active investment that requires a lot of time, energy, and resources. Purchasing a DST that is actively managed by a best-in-class operator allows investors to enjoy the many potential benefits of owning real estate passively without ongoing management responsibilities.

Reduced Competition

Delaware Statutory Trust properties are pre-vetted, pre-financed and pre-closed. This alleviates the burden of competing with other buyers when acquiring investment properties. The properties are ready to be identified and closing can begin immediately.

Quick Close

The Delaware Statutory Trust (DST) owns the properties prior to investors purchasing beneficial interests within the DST. Investors can typically close within 2-3 business days.

Hassle-free 45-Day Identification

Investors can create a backup for their 1031 exchange by identifying a DST as replacement property in the event other identified property transactions fail.

Asset & Liability Protection

A Delaware Statutory Trust (DST) offers limited liability to an investor’s personal assets through the bankruptcy-remote provision within the trust. This means, in the event the trust fails, the most investors are at risk of losing is their original investment.

Transparent Online Property Documentation

Access Offering Brochures, Private Placement Memorandums (PPM), due diligence documents, subscription documents and more.

Simple Tax Reporting

Investors receive year-end operating statements denoting their pro-rata shares of operating expenses and rental income along with forms 1099 (income) and 1098 (mortgage interest).

Dedicated Advisory Team

Exchange-X’s team of dedicated licensed professionals offer ongoing support.

Conclusion

We hope this article gave you a good overview of who we are and how we can be a resource for your next 1031 exchange.

If you are considering a 1031 exchange or have additional questions about the process, don’t go it alone. Our experts at Exchange-X have helped countless investors navigate the 1031 exchange process successfully, and we would love to assist you as well.

If you are ready to start a 1031 exchange, or have additional questions, schedule a consultation with one of our experts at Exchange-X.

To learn more about how 1031 exchanges and Delaware Statutory Trusts (DST) can complement your portfolio, visit our website for additional resources.

Join Exchange-X! Click the link above to create an account now and be the first to know about upcoming opportunities.

Download your free copy of “The Power of 1031 Exchanges and Delaware Statutory Trusts (DSTs)” to learn more about how Delaware Statutory Trusts (DST) can complement your portfolio.