A 1031 exchange, also known as a like-kind exchange, is a powerful tax strategy that allows real estate investors to defer capital gains taxes by selling one property and acquiring a similar replacement property. This strategy has gained popularity among savvy investors looking to potentially maximize their returns and build long term wealth. This comprehensive guide will explore the basics of the 1031 exchange, its potential benefits, requirements, and important considerations to remember.

In this article we will discuss important topics such as:

- What is a 1031 Exchange?

- How Does A 1031 Exchange Work?

- Pros and Cons of Doing a 1031 Exchange

- 1031 Exchange Example

- Can You Use A 1031 Exchange to Invest In a Delaware Statutory Trust (DST)?

- What is a Delaware Statutory Trust (DST)?

- FAQs about 1031 Exchanges

What is a 1031 Exchange?

The term “1031” refers to Section 1031 of the U.S. Internal Revenue Code, which outlines the rules and regulations governing this type of exchange.

The primary purpose of a 1031 exchange is to encourage investment, stimulate economic growth, and provide tax incentives for real estate investors. By deferring the payment of capital gains taxes, investors can retain more funds for reinvestment and potentially increase their purchasing power.

In a 1031 exchange, the properties involved must be of “like-kind,” which means they should be similar in character. While this term may sound restrictive, it has a broad interpretation in the context of real estate. Most real estate properties, including residential, commercial, industrial, and vacant land, are all considered like-kind to each other.

The process of a 1031 exchange involves several key steps. First, the investor sells their current property, the relinquished property. Within 45 days of the sale, they must identify one or more potential replacement properties for their exchange. The investor then has 135 days (180 days from sale) to acquire the replacement properties previously identified. It is important to note that the exchange must be facilitated through a qualified intermediary (QI). This independent third-party entity assists in the exchange process.

By utilizing a 1031 exchange, investors can defer capital gains taxes on the sale of their properties, allowing them to reinvest the total value of their sales proceeds into new properties. This tax deferral strategy provides the potential for wealth accumulation, portfolio growth, enhanced cash flow, and diversification opportunities.

However, it is crucial to comply with IRS regulations and meet specific deadlines and requirements to ensure the validity of a 1031 exchange. Engaging a qualified intermediary and consulting with tax and legal professionals are recommended to navigate the complexities of this tax strategy successfully.

It is important to note that while a 1031 exchange provides tax deferral benefits, it does not eliminate the tax liability. If the investor eventually sells the replacement property without engaging in another 1031 exchange, they will be responsible for paying the deferred capital gains taxes at that time.

To learn more, read What is a 1031 Exchange?

How Does A 1031 Exchange Work?

Here is a step-by-step breakdown of how a 1031 exchange typically works:

Sale of the Relinquished Property:

The investor decides to sell their current property, referred to as the relinquished property. This property can be residential, commercial, industrial, or vacant land. The sale proceeds are held by a qualified intermediary (QI) instead of being directly received by the investor.

Identification of Replacement Property (45-Days):

Within 45 days of selling the relinquished property, the investor must identify potential replacement properties that meet the “like-kind” requirement. The title must be done in writing and provided to the QI. The investor has three ID methods to identify the replacement properties.

- Three Property Rule: Identify up to three potential replacement properties, regardless of their value.

- 200% Rule: Identify any number of properties, as long as their combined weight does not exceed 200% of the relinquished property’s value.

- 95% Rule: Identify more than three properties with a total value that is more than 200% of the value of the relinquished property, but only if the taxpayer acquires at least 95% of the value of the properties that he identifies.

Purchase of Replacement Property (180-Days):

After identifying the replacement property, the investor has 180 days from the sale of the relinquished property to complete the acquisition of the replacement property. The QI uses the funds held from the sale of the relinquished property to acquire the replacement property on behalf of the investor.

To learn more, read How does a 1031 Exchange Work? and The 1031 Exchange Process Explained .

Pros and Cons of Doing a 1031 Exchange

A 1031 exchange, also known as a “like-kind” exchange, offers several potential advantages for real estate investors. However, it is essential to consider both the potential benefits and drawbacks before deciding to engage in a 1031 exchange. Here are some pros and cons to help you evaluate whether a 1031 exchange aligns with your investment goals.

Potential Pros:

Tax Deferral: One of the primary benefits of a 1031 exchange is the ability to defer capital gains taxes on the sale of a property. By reinvesting the proceeds into a like-kind replacement property, investors can postpone paying taxes, allowing them to retain more funds for reinvestment.

Increased Purchasing Power: By deferring taxes, investors have more capital available for reinvestment. This increased purchasing power allows for acquiring higher-value or multiple properties, potentially accelerating portfolio growth.

Cash Flow Enhancement: By deferring taxes, investors can allocate more capital to income-generating properties. This may lead to potential enhanced cash flow and higher returns on investment.

Portfolio Diversification: A 1031 exchange provides an opportunity for portfolio diversification. Investors can exchange properties in one location for properties in different geographic areas or asset classes, spreading risk and potentially optimizing their portfolio’s performance.

Wealth Accumulation: Through successive 1031 exchanges, investors can continuously defer capital gains taxes, effectively compounding their wealth over time. This compounding effect can potentially contribute to long-term wealth accumulation.

Potential Cons:

Replacement Property Availability and Timing: Finding suitable replacement properties within the designated time frame can be challenging. Limited inventory, competitive markets, or specific investment criteria may restrict options for investors. Meeting the strict deadlines for identification and acquisition can also add pressure and potential risks.

Transaction Costs: Engaging in a 1031 exchange incurs additional costs. These costs may include fees associated with a qualified intermediary (QI), title transfers, due diligence, and other transaction-related expenses. Considering these costs and factoring them into the overall investment strategy is essential.

Relinquished Property Sale Constraints: The decision to engage in a 1031 exchange may require selling a property that an investor would otherwise prefer to retain. This can limit flexibility and potential opportunities to hold onto an asset with solid performance or sentimental value.

Potential Future Tax Liability: While a 1031 exchange allows for tax deferral, it does not eliminate the tax liability. If an investor eventually sells the replacement property without engaging in another 1031 exchange, they will be responsible for paying the deferred capital gains taxes at that time.

Complex Process and Compliance: Engaging in a 1031 exchange involves adhering to strict IRS rules and regulations. The process can be complex and requires careful planning, coordination with professionals, and timely execution to ensure compliance and maximize the benefits of the exchange.

It is crucial to thoroughly evaluate these pros and cons in the context of your specific investment objectives and circumstances. Consulting with tax advisors, real estate professionals, and qualified intermediaries is recommended to make an informed decision and successfully navigate the complexities of a 1031 exchange.

1031 Exchange Example

To illustrate how a 1031 exchange works in practice, let’s consider a hypothetical example:

(Please not that this is not, nor can there be, a promise of performance, and it’s only intended to illustrate mathematical principals)

John, an experienced real estate investor, owns a residential rental property in a desirable location. He initially purchased the property for $200,000, and after several years of ownership and market appreciation, it is now valued at $400,000. If John decides to sell the property, he would be subject to capital gains taxes on the $200,000 profit.

However, instead of paying the taxes, John utilizes a 1031 exchange to defer the tax liability and reinvest the proceeds into another property. Here’s how the exchange unfolds:

Sale of the Relinquished Property: John lists his residential rental property for sale and finds a buyer willing to purchase it for the market value of $400,000. The sale proceeds would be subject to capital gains taxes.

Engaging a Qualified Intermediary (QI): John engages a qualified intermediary, an independent third party, prior to the close to facilitate the 1031 exchange. The QI handles the funds from the sale and ensures compliance with IRS regulations throughout the exchange process.

Identification of Replacement Property: Within 45 days of selling the relinquished property, John identifies a potential replacement property valued at $500,000. The exchange property must be equal to or greater value then the relinquished property.

Purchase of Replacement Property: John has 180 days from the relinquished property’s sale (135 days from 45-day ID expiration) to complete the replacement property’s acquisition. With the assistance of the QI, he uses the proceeds from the sale to acquire the commercial property for $500,000.

By engaging in the 1031 exchange, John effectively defers the capital gains taxes that would have been due on the $200,000 profit from the sale of his residential rental property. The taxes are delayed because he reinvests the proceeds into a like-kind replacement property.

Now, John owns a commercial property worth $500,000 without incurring immediate tax liabilities. He has successfully leveraged the 1031 exchange to preserve his investment capital and potentially enhance his real estate portfolio.

It’s important to note that the example above is simplified, and each 1031 exchange may have unique circumstances and considerations. Consulting with professionals, such as tax advisors and qualified intermediaries, is crucial to ensure compliance with IRS regulations and attempt maximize the potential benefits of a 1031 exchange based on individual circumstances.

Can You Use A 1031 Exchange to Invest in A Delaware Statutory Trust?

Yes. DST interest qualifies as “like-kind” property under IRC 1031 exchange rules.

What is a Delaware Statutory Trust (DST)?

A Delaware Statutory Trust (DST) is a legal entity created under Delaware law that permits fractional ownership of real estate assets.

- DSTs are classified as “direct interests” and possess the unique ability to qualify for the 1031 exchange

- Tax benefits include capital gains and depreciation recapture deferral, mortgage interest deductions, and more

- An Exchanger can choose to defer taxes by reinvesting in a DST, rather than a traditional fee-simple property

You can use a 1031 exchange to invest in a Delaware statutory trust (DST). A DST is a type of real estate investment trust (REIT) that is organized as a trust under Delaware law. DSTs are typically used to acquire and manage large commercial properties, such as apartment buildings, office buildings, and retail centers.

To qualify for a 1031 exchange, the replacement property must be “like-kind” to the property being sold. In the case of a DST, the replacement property would be the beneficial interest in the trust. The beneficial interest is a type of security that gives the investor a share of the trust’s assets and income.

If you are considering using a 1031 exchange to invest in a DST, it is essential to work with a qualified tax advisor to ensure the transaction complies with IRS regulations.

To learn more, read What is a Delaware Statutory Trust (DST)?

Some potential benefits of using a 1031 exchange to invest in a DST:

- Defer paying capital gains taxes on selling your investment property.

- Invest in a diversified portfolio of commercial real estate properties.

- No landlord responsibilities through professional management and leasing services.

- Possibility of monthly income distributions from the DST.

- Lower minimum investment amounts.

However, there are also some drawbacks to consider, such as:

- DSTs are illiquid investments, making them difficult to sell.

- DSTs investors lack control over management and sale decisions.

- DSTs are subject to the same risks as any other real estate investment, such as changes in market conditions and tenant vacancies.

Using a 1031 exchange to invest in a DST can be an excellent way to defer paying capital gains taxes and diversify your real estate portfolio. However, it is essential to carefully consider the potential benefits and drawbacks before deciding.

FAQs about 1031 Exchanges

FAQ 1: Does a 1031 exchange only applicable to real estate?

Under the Tax Cuts and Jobs Act, Section 1031 now applies only to exchanges of real property and not of personal or intangible property.

Thus, effective January 1, 2018, exchanges of machinery, equipment, vehicles, artwork, collectibles, patents and other intellectual property and intangible business assets generally do not qualify for non-recognition of gain or loss as like-kind exchanges.

FAQ 2: Can I complete a 1031 exchange with multiple replacement properties?

It is possible to identify and acquire multiple replacement properties in a 1031 exchange. However, specific rules and limitations exist regarding the number of properties that can be identified and received within the designated time frames.

FAQ 3: Are there any restrictions on the location of replacement properties?

No geographical restrictions exist when identifying and acquiring replacement properties in a 1031 exchange. Investors have the freedom to explore opportunities nationwide.

FAQ 4: What happens if I need help identifying a replacement property within 45 days?

An investor must identify a replacement property within the 45-day identification period to ensure the exchange is considered successful. The 45-day ID period includes weekends and holidays, so plan accordingly.

FAQ 5: Can I use a 1031 exchange for my primary residence?

No, the primary residence or personal use property does not qualify for a 1031 exchange. This provision is strictly applicable to investment or business properties.

FAQ 6: Can I use a 1031 exchange to buy a property before selling my current one?

Yes, this is known as a Reverse Exchange. A “Reverse” exchange occurs when the taxpayer acquires the replacement property before transferring the relinquished property. A “pure” reverse exchange, where the taxpayer owns both the relinquished and replacement properties at the same time, is not permitted. The IRS has provided guidance on structuring a reverse exchange, offering a safe harbor under Rev. Proc. 2000-37.

It is recommended to seek professional advice from a tax advisor or Qualified Intermediary (QI) when performing a Reverse Exchange.

For more FAQs, visit the FAQ section of our site.

Conclusion

Delaware Statutory Trusts (DST) come with many potential benefits, especially for 1031 exchangers looking for passive investment options. Understanding what a DST is and how to one works can have a major impact on your overall investment portfolio.

Investing in a Delaware Statutory Trust is a great way to diversify your portfolio into higher-grade properties, while giving you the ability to defer capital gains taxes through a 1031 exchange. DST investors can close quickly and can allocate smaller minimum investments making a DST a great option for 1031 exchange ID and boot backup. Built in professional asset management also makes owning a DST a passive investment which serves as a great estate planning tool.

Our team at Exchange-X has years of experience with DSTs and would be glad to help you navigate the process. If you are in a 1031 exchange or want to learn more about how DSTs can complement your portfolio, schedule a call with an advisor or call (888) 775-1031 today.

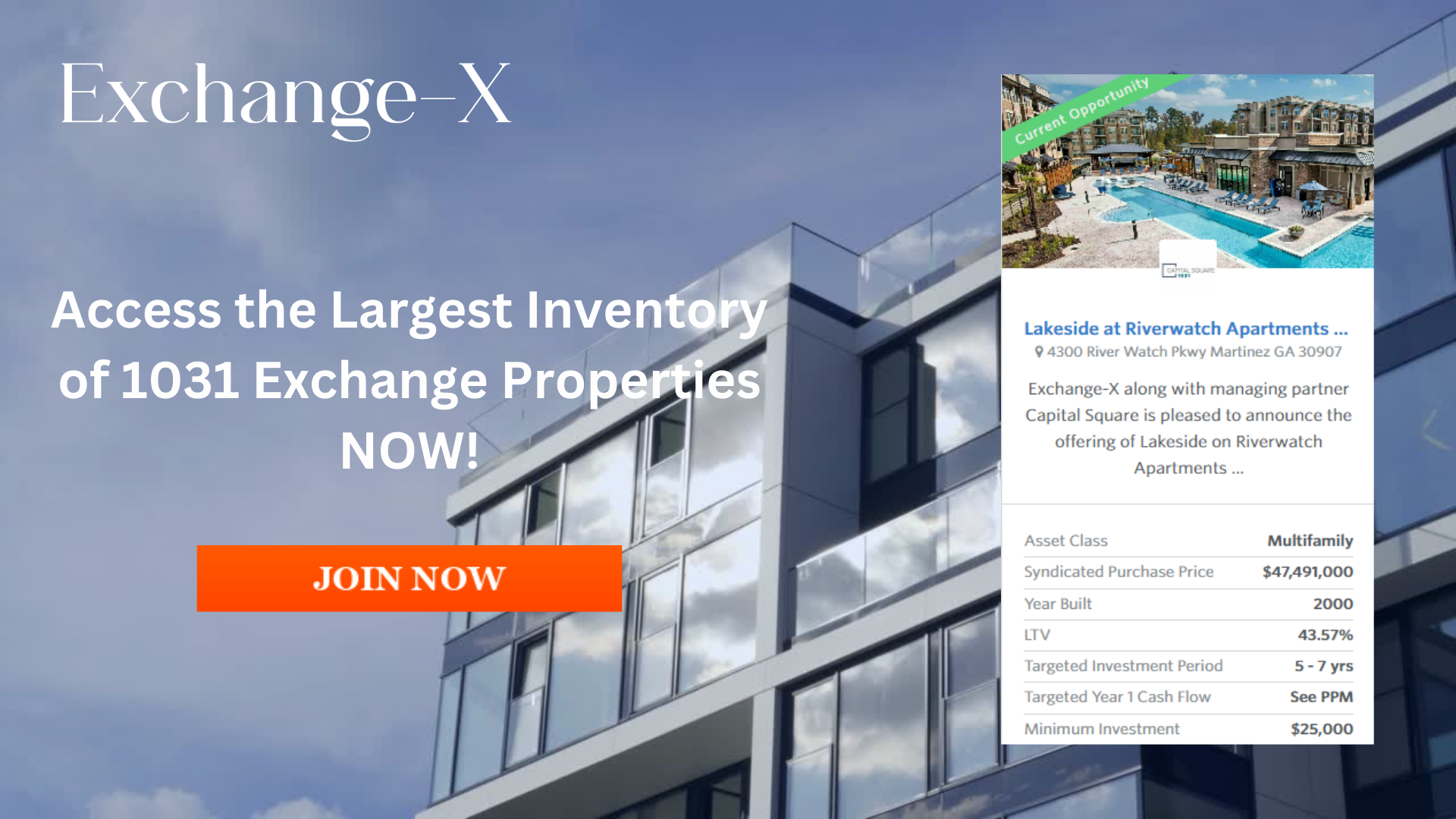

Join Exchange-X! Click the link above to create an account now and be the first to know about upcoming opportunities.

Download your free copy of “The Power of 1031 Exchanges and Delaware Statutory Trusts (DSTs)” to learn more about how Delaware Statutory Trusts (DST) can complement your portfolio.

Full Disclaimer Copyright 2023 Exchange-X, LLC. All rights reserved.

The contents of this communication: (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, (ii) offers can be made only by the confidential Private Placement Memorandum (the “PPM”) which is available upon request, (iii) do not and cannot replace the PPM and is qualified in its entirety by the PPM, and (iv) may not be relied upon in making an investment decision related to any investment offering by the respective issuer, or any affiliate, or partner thereof (“Issuer”). All potential investors must read the PPM and no person may invest without acknowledging receipt and complete review of the PPM. With respect to the “targeted” goals and performance levels outlined herein, these do not constitute a promise of performance, nor is there any assurance that the investment objectives of any program will be attained. These “targeted” factors are based upon reasonable assumptions more fully outlined in the Offering Documents/ PPM. Consult the PPM for investment conditions, risk factors, minimum requirements, fees and expenses and other pertinent information with respect to any investment. These investment opportunities have not been registered under the Securities Act of 1933 and are being offered pursuant to an exemption therefrom and from applicable state securities laws. Past performance are no guarantee of future results. All information is subject to change. You should always consult a tax professional prior to investing. Investment offerings and investment decisions may only be made on the basis of a confidential private placement memorandum issued by Issuer, or one of its partner/issuers. Issuer does not warrant the accuracy or completeness of the information contained herein. Thank you for your cooperation.

Securities offered through Emerson Equity, LLC Member: FINRA, SIPC (CRD#: 130032/SEC#: 801-71293,8-66296). Only available in states where Emerson Equity, LLC is registered. Emerson Equity, LLC is not affiliated with any other entities identified in this communication.

For more information, read our Disclosures & Disclaimers and Terms of Use.

1031 Risk Disclosure:

- There is no guarantee that any strategy will be successful or achieve investment objectives;

- Potential for property value loss – All real estate investments have the potential to lose value during the life of the investments;

- Change of tax status – The income stream and depreciation schedule for any investment property may affect the property owner’s income bracket and/or tax status. An unfavorable tax ruling may cancel deferral of capital gains and result in immediate tax liabilities;

- Potential for foreclosure – All financed real estate investments have potential for foreclosure;

- Illiquidity – Because 1031 exchanges are commonly offered through private placement offerings and are illiquid securities. There is no secondary market for these investments;

- Reduction or Elimination of Monthly Cash Flow Distributions – Like any investment in real estate, if a property unexpectedly loses tenants or sustains substantial damage, there is potential for suspension of cash flow distributions;

- Impact of fees/expenses – Costs associated with the transaction may impact investors’ returns and may outweigh the tax benefits.