In today’s market, there is no shortage of investment vehicles to choose from. The goal is to find the best investments to suit a well-balanced portfolio. Recently, real estate owners and investors alike are taking notice to owning Delaware Statutory Trusts (DST) and the many potential advantages they provide.

In this article we are going to further touch on some key topics relating to Delaware Statutory Trusts (DST) including:

- What is a Delaware Statutory Trust (DST)?

- How is a Delaware Statutory Trusts (DST) Structured?

- How to Invest in a Delaware Statutory Trust (DST)?

What is a Delaware Statutory Trust (DST)

A Delaware Statutory Trust (DST) is a legal entity created under Delaware law that permits fractional ownership of real estate assets. For investors that are not interested in the day-to-day management of investment property, consider a Delaware statutory trust (DST) as a solution.

DSTs provide the benefits of incorporating commercial real estate into an investment portfolio without the hassle of management responsibilities. This is also known as a passive investment real estate strategy. Qualified investors can access a DST directly with cash or through a 1031 like-kind exchange.

Read our articles titled What is a Delaware Statutory Trust (DST) and 10 Potential Advantages of Owning a Delaware Statutory Trust (DST) to learn more.

How is a Delaware Statutory Trusts (DST) Structured?

Since the year 2004, Delaware Statutory Trusts (DST) have increasingly been used as a form of real estate ownership offering investors several advantages over the Tenant In Common (TIC) structure.

Originally when real estate syndications began, if an investor wanted to participate in a fund structure, they were bound to an antiquated model know as Tenant In Common or “TIC”. Although TICs had their advantages, there were many disadvantages associated, mainly ownership. In a TIC, all investors have equal voting rights, making decisions a very difficult task.

For example, if a TIC had 40 investors, all 40 partners would have to unanimously agree on any forward decisions or changes to the underlying asset. This was especially difficult when incorporating things like budgeting, management, development and exiting of the asset. The Delaware Statutory Trust offers a simple alternative to TIC structures without the headaches.

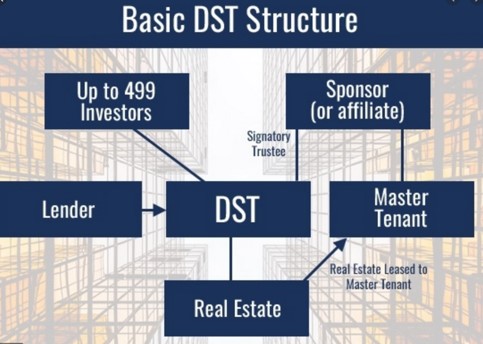

Let’s look at how a basic DST is structured and some advantages they can offer.

A Delaware Statutory Trust (DST) is a trust created by a separate legal entity, usually a sponsor/developer (general partner) for the purpose of owning assets. The trust allows up to 499 investors (limited partners) to participate in the trust. Once the trust is established, the sponsor can purchase real estate, securities, private businesses, etc. within the fund. The DST can then secure financing against the assets within the trust. Debt within a DST is non-recourse, offering an added layer of protection to the limited partners.

The general partners are the asset managers who handle all aspects of property management including market analysis, local architectural, zoning & building boards, contractors for rehab/development, inspections, leasing, financing & closing, etc.

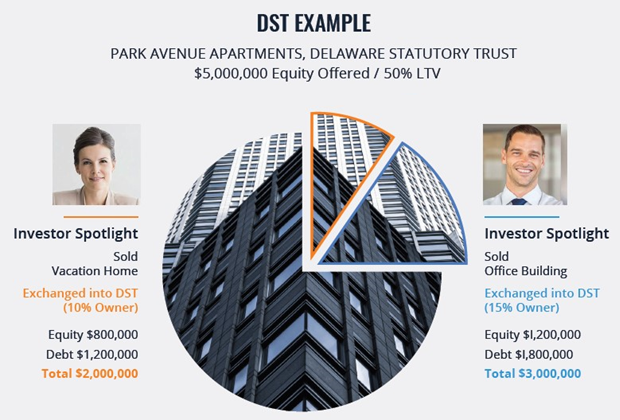

Below is an example of what ownership within a Delaware Statutory Trust looks like.

*This example is for illustrative purposes only and does not represent an actual offering

Limited partners of a Delaware Statutory Trust (DST) own beneficial interests withing the trust making the DST a powerful tool when considering a 1031 exchange. Real estate owned within a DST is recognized by the IRS as 1031 exchange eligible, giving the DST the ability to exchange property into and from the trust. This is the single biggest advantage of owning a DST over public/private Real Estate Investment Trusts (REITs).

How to Invest in a Delaware Statutory Trust (DST)?

Setting up a Delaware Statutory Trust (DST) for the purpose of syndicating real estate can be extremely costly. This maybe a viable option for a few active owners looking to be hands on and syndicate deals internally. For the rest of us, investing directly within an established DST is most practical and comes with a plethora of potential benefits.

Consider Exchange-X.

Exchange-X is a leading 1031 exchange real estate investment platform which provides a simple solution for real estate investors & 1031 exchange buyers. The Exchange-X Marketplace offers direct access to over 50 leading DTS sponsors and dozens of active offerings. Accredited investors gain instant access to the largest selection of passive, 1031 DST replacement properties sponsored by leading REIT, private equity, and development firms.

Members can view, analyze, and directly purchase investment grade real estate properties, along with accessing important offering documents such as offering Brochures, Private Placement Memorandums (PPM), due-diligence docs, property overviews and more.

Simply register to view available 1031 DST properties or go to www.Exchange-X.com to learn more.

Check out Exchange-X: How it Works to learn more.

Conclusion

In this article we covered important topics on what is a Delaware Statutory Trusts (DST), how one is structured and how an investor can gain direct access. DSTs stand to be an excellent alternative for the accredited investor looking to make the shift from active management to a passive management role or simply looking to diversify their portfolio with institutional quality real estate.

A DST is also eligible for a tax deferred 1031 exchange, giving investors several potential tax advantages over other structures like public and private REITs.

If you are considering a 1031 exchange or have additional questions about the process, don’t go it alone. Our experts at Exchange-X have helped countless investors navigate the 1031 exchange process successfully, and we would love to assist you as well.

Ready to start a 1031 exchange or have additional questions? Schedule a consultation with one of our experts today.

To learn more about how 1031 exchanges and Delaware Statutory Trusts (DST) can complement your portfolio, visit our Resource Center .

Join Exchange-X! Click the link above to create an account now and be the first to know about upcoming opportunities.

Download your free copy of “The Power of 1031 Exchanges and Delaware Statutory Trusts (DSTs)” to learn more about how Delaware Statutory Trusts (DST) can complement your portfolio.

Full Disclaimer Copyright 2023 Exchange-X, LLC. All rights reserved.

The contents of this communication: (i) do not constitute an offer of securities or a solicitation of an offer to buy securities, (ii) offers can be made only by the confidential Private Placement Memorandum (the “PPM”) which is available upon request, (iii) do not and cannot replace the PPM and is qualified in its entirety by the PPM, and (iv) may not be relied upon in making an investment decision related to any investment offering by the respective issuer, or any affiliate, or partner thereof (“Issuer”). All potential investors must read the PPM and no person may invest without acknowledging receipt and complete review of the PPM. With respect to the “targeted” goals and performance levels outlined herein, these do not constitute a promise of performance, nor is there any assurance that the investment objectives of any program will be attained. These “targeted” factors are based upon reasonable assumptions more fully outlined in the Offering Documents/ PPM. Consult the PPM for investment conditions, risk factors, minimum requirements, fees and expenses and other pertinent information with respect to any investment. These investment opportunities have not been registered under the Securities Act of 1933 and are being offered pursuant to an exemption therefrom and from applicable state securities laws. Past performance are no guarantee of future results. All information is subject to change. You should always consult a tax professional prior to investing. Investment offerings and investment decisions may only be made on the basis of a confidential private placement memorandum issued by Issuer, or one of its partner/issuers. Issuer does not warrant the accuracy or completeness of the information contained herein. Thank you for your cooperation.

Securities offered through Emerson Equity, LLC Member: FINRA, SIPC (CRD#: 130032/SEC#: 801-71293,8-66296). Only available in states where Emerson Equity, LLC is registered. Emerson Equity, LLC is not affiliated with any other entities identified in this communication.

For more information, read our Disclosures & Disclaimers and Terms of Use.

1031 Risk Disclosure:

- There is no guarantee that any strategy will be successful or achieve investment objectives;

- Potential for property value loss – All real estate investments have the potential to lose value during the life of the investments;

- Change of tax status – The income stream and depreciation schedule for any investment property may affect the property owner’s income bracket and/or tax status. An unfavorable tax ruling may cancel deferral of capital gains and result in immediate tax liabilities;

- Potential for foreclosure – All financed real estate investments have potential for foreclosure;

- Illiquidity – Because 1031 exchanges are commonly offered through private placement offerings and are illiquid securities. There is no secondary market for these investments;

- Reduction or Elimination of Monthly Cash Flow Distributions – Like any investment in real estate, if a property unexpectedly loses tenants or sustains substantial damage, there is potential for suspension of cash flow distributions;

- Impact of fees/expenses – Costs associated with the transaction may impact investors’ returns and may outweigh the tax benefits.